Regulatory Support

The Global Remote Deposit Capture Market Industry benefits from supportive regulatory frameworks that encourage the adoption of digital banking solutions. Governments and regulatory bodies are increasingly recognizing the importance of remote deposit capture in promoting financial inclusion and enhancing the efficiency of banking operations. Initiatives aimed at modernizing banking regulations and encouraging technological innovation are likely to foster a conducive environment for market growth. As regulations evolve to support digital transactions, financial institutions may be more inclined to invest in remote deposit capture technologies, further propelling the industry's expansion.

Emerging Markets Growth

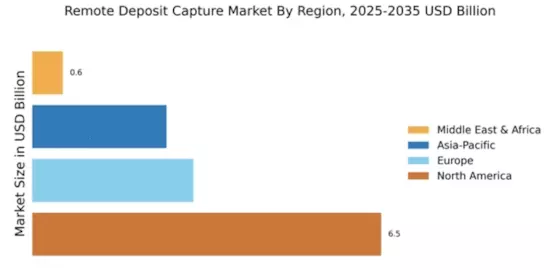

The Global Remote Deposit Capture Market Industry is poised for growth in emerging markets, where financial inclusion remains a critical focus. As developing economies enhance their banking infrastructure, the adoption of remote deposit capture solutions is expected to rise. These markets present unique opportunities for financial institutions to reach underserved populations and provide them with convenient banking services. The increasing penetration of smartphones and internet connectivity in these regions is likely to facilitate the adoption of remote deposit capture technologies, contributing to the overall growth of the market.

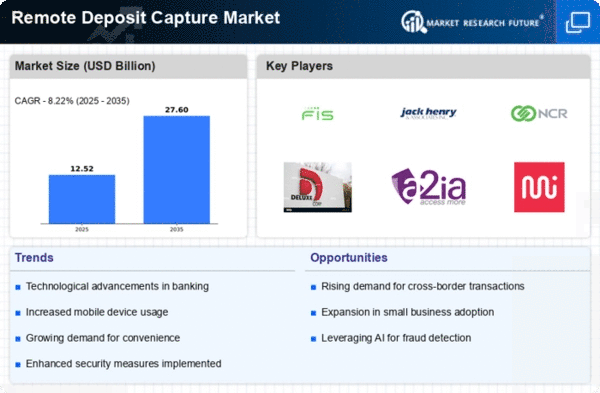

Market Growth Projections

The Global Remote Deposit Capture Market Industry is projected to experience substantial growth, with estimates indicating an increase from 11.6 USD Billion in 2024 to 27.6 USD Billion by 2035. This growth trajectory suggests a robust market environment, driven by various factors such as technological advancements, increased adoption by financial institutions, and rising consumer demand for convenience. The anticipated CAGR of 8.22% from 2025 to 2035 further underscores the potential for expansion within the industry. Charts illustrating these projections will provide a visual representation of the market's anticipated growth.

Technological Advancements

The Global Remote Deposit Capture Market Industry is experiencing rapid technological advancements that enhance user experience and operational efficiency. Innovations such as artificial intelligence and machine learning are being integrated into remote deposit systems, allowing for improved fraud detection and risk management. For instance, banks are utilizing advanced image processing technologies to ensure higher accuracy in check scanning. This technological evolution is likely to attract more financial institutions to adopt remote deposit capture solutions, contributing to the market's projected growth from 11.6 USD Billion in 2024 to 27.6 USD Billion by 2035, with a CAGR of 8.22% from 2025 to 2035.

Consumer Demand for Convenience

The Global Remote Deposit Capture Market Industry is significantly influenced by consumer demand for convenience and accessibility in banking services. As customers increasingly prefer digital banking solutions, remote deposit capture offers a seamless way to deposit checks from the comfort of their homes or offices. This shift in consumer behavior is prompting financial institutions to enhance their digital offerings, thereby driving the adoption of remote deposit capture technologies. The growing expectation for quick and efficient banking services is likely to propel the market forward, as institutions strive to meet these evolving consumer preferences.

Increased Adoption by Financial Institutions

The Global Remote Deposit Capture Market Industry is witnessing increased adoption by various financial institutions, driven by the need for operational efficiency and customer convenience. Many banks and credit unions are implementing remote deposit capture solutions to streamline their processes and reduce costs associated with physical check processing. This trend is particularly evident among smaller institutions that seek to compete with larger banks. As more institutions recognize the benefits of remote deposit capture, the market is expected to expand significantly, aligning with the overall growth trajectory projected for the industry.