Environmental Regulations

Stringent environmental regulations in China are propelling the electric-bus market forward. The government has set ambitious targets to reduce carbon emissions, aiming for a 60-65% reduction by 2030 compared to 2005 levels. This regulatory framework encourages public transport operators to transition from diesel to electric buses, as electric vehicles (EVs) are seen as a viable solution to meet these targets. Additionally, cities are implementing low-emission zones, further incentivizing the adoption of electric buses. The automotive electric-bus market is thus positioned to benefit from these regulatory pressures, as compliance with environmental standards becomes increasingly critical for public transport systems. The shift towards cleaner transportation options is expected to drive demand for electric buses, aligning with national sustainability goals.

Infrastructure Development

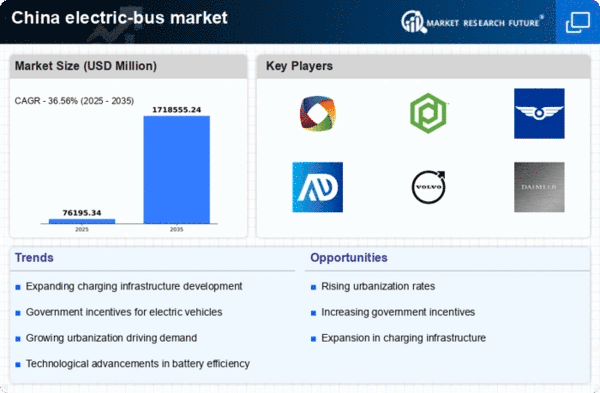

The expansion of charging infrastructure is a crucial driver for the electric-bus market in China. As the government invests heavily in the development of electric vehicle (EV) charging stations, the accessibility of charging points is expected to increase significantly. Reports indicate that by 2025, the number of public charging stations could reach over 1 million, facilitating the adoption of electric buses. This infrastructure growth not only alleviates range anxiety among operators but also enhances the operational efficiency of electric buses. Furthermore, the integration of smart grid technology may optimize energy distribution, making it more feasible for transit authorities to deploy electric buses. Consequently, the automotive electric-bus market is likely to experience accelerated growth as infrastructure becomes more robust and widespread.

Public Awareness and Acceptance

Increasing public awareness and acceptance of electric vehicles are driving the electric-bus market in China. As environmental concerns gain prominence, citizens are becoming more supportive of sustainable transportation solutions. Public campaigns and educational initiatives are fostering a positive perception of electric buses, highlighting their benefits such as reduced emissions and lower noise pollution. Surveys indicate that a growing % of the population is willing to use electric public transport options, reflecting a shift in consumer attitudes. This heightened acceptance is encouraging transit authorities to invest in electric buses, as they align with public expectations for cleaner and more efficient transportation. Consequently, the automotive electric-bus market is likely to thrive as societal attitudes continue to evolve in favor of sustainable mobility solutions.

Economic Incentives for Operators

Economic incentives provided by the Chinese government are significantly influencing the electric-bus market. Subsidies and financial support for electric bus purchases can reduce the initial investment burden for transit authorities. Reports suggest that these incentives can cover up to 50% of the purchase price of electric buses, making them more financially attractive compared to traditional diesel buses. Additionally, lower operational costs associated with electric buses, such as reduced fuel and maintenance expenses, further enhance their appeal. As a result, public transport operators are increasingly inclined to invest in electric buses, thereby stimulating growth in the automotive electric-bus market. This trend is likely to continue as economic incentives evolve to support the transition towards sustainable public transportation.

Technological Innovations in Battery Technology

Advancements in battery technology are a pivotal driver for the electric-bus market in China. The development of high-capacity, fast-charging batteries is enhancing the performance and range of electric buses. Innovations such as lithium-sulfur and solid-state batteries are being explored, which could potentially increase energy density and reduce charging times. As battery costs continue to decline, the overall affordability of electric buses is expected to improve, making them more competitive against conventional buses. Furthermore, the automotive electric-bus market may benefit from the growing emphasis on energy efficiency and longer lifespans of batteries, which could lead to lower total cost of ownership for operators. These technological advancements are likely to play a crucial role in shaping the future landscape of electric public transportation.