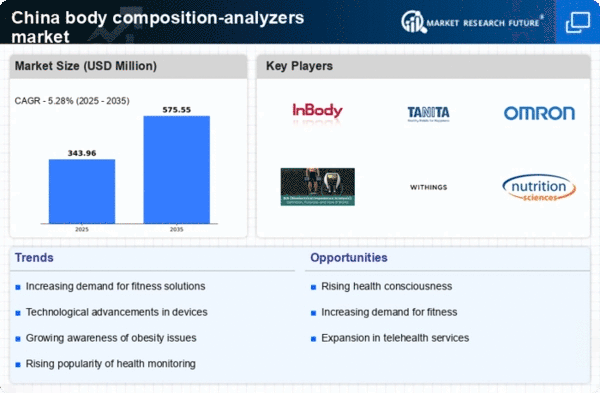

The body composition-analyzers market in China is characterized by a dynamic competitive landscape, driven by increasing health awareness and the rising prevalence of lifestyle-related diseases. Major players such as InBody (KR), Tanita (JP), and Omron (JP) are strategically positioned to leverage these trends. InBody (KR) focuses on innovation, particularly in developing advanced bioelectrical impedance analysis technologies, which enhances the accuracy of body composition measurements. Tanita (JP) emphasizes regional expansion, having recently increased its distribution channels across tier-2 cities in China, thereby broadening its market reach. Omron (JP) is investing in digital transformation, integrating smart technology into its devices to provide users with real-time health data, which aligns with the growing demand for connected health solutions. Collectively, these strategies contribute to a competitive environment that is increasingly focused on technological advancement and market penetration.

Key business tactics employed by these companies include localizing manufacturing and optimizing supply chains to reduce costs and improve efficiency. The market structure appears moderately fragmented, with several key players holding substantial market shares while also facing competition from emerging brands. This fragmentation allows for diverse product offerings and innovation, as companies strive to differentiate themselves in a crowded marketplace.

In October 2025, InBody (KR) launched a new line of portable body composition analyzers designed for personal use, which could potentially disrupt the market by making advanced health monitoring accessible to a broader audience. This strategic move not only caters to the growing trend of home health monitoring but also positions InBody (KR) as a leader in consumer-centric health technology. The introduction of these devices may enhance brand loyalty and expand their customer base significantly.

In September 2025, Tanita (JP) announced a partnership with a leading fitness app to integrate its body composition data into the app's health tracking features. This collaboration is likely to enhance user engagement and provide a more comprehensive health management solution, thereby reinforcing Tanita's market position. By aligning with digital platforms, Tanita (JP) appears to be capitalizing on the trend of interconnected health ecosystems, which could lead to increased sales and brand visibility.

In August 2025, Omron (JP) unveiled a new AI-driven body composition analyzer that offers personalized health insights based on user data. This innovation not only reflects Omron's commitment to integrating cutting-edge technology into its products but also addresses the growing consumer demand for tailored health solutions. The strategic importance of this development lies in its potential to attract tech-savvy consumers and enhance user experience, thereby solidifying Omron's competitive edge.

As of November 2025, current trends in the body composition-analyzers market include a strong emphasis on digitalization, sustainability, and AI integration. Strategic alliances among key players are shaping the competitive landscape, fostering innovation and enhancing product offerings. The shift from price-based competition to a focus on technological advancement and supply chain reliability is evident, suggesting that future competitive differentiation will hinge on the ability to innovate and adapt to consumer needs.