Increasing Demand for Fitness Solutions

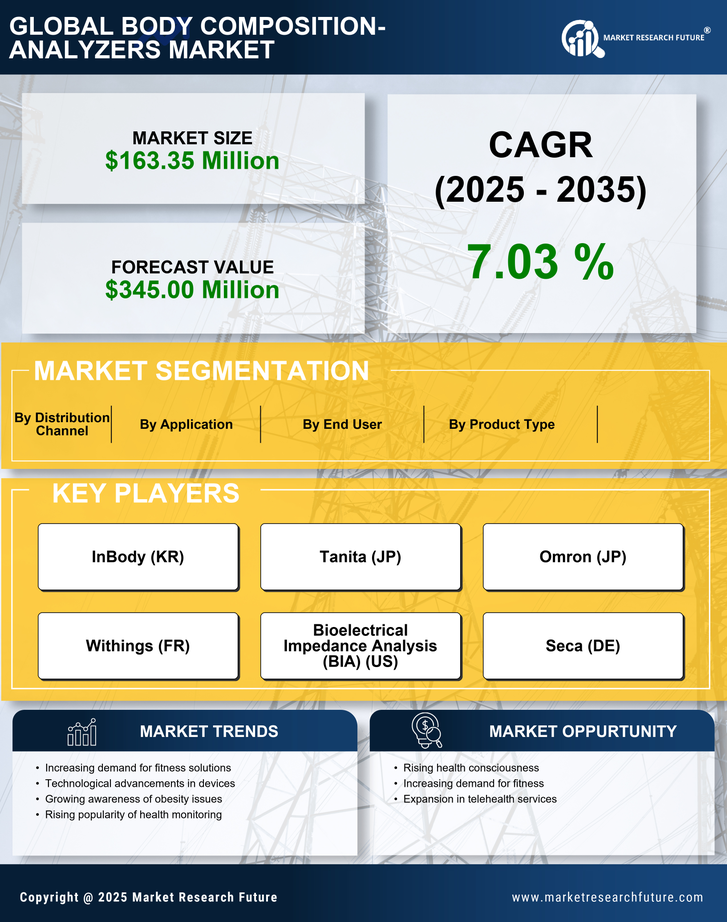

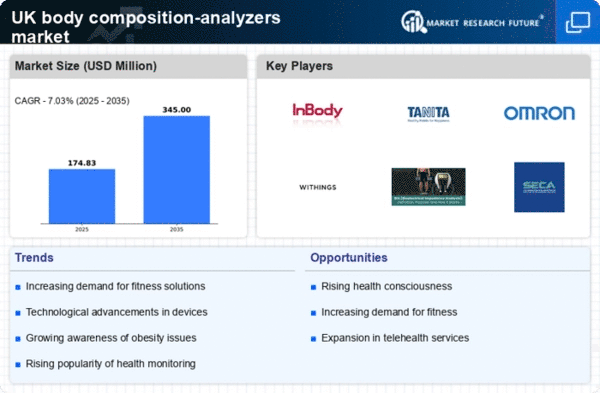

The body composition-analyzers market is experiencing a notable surge in demand as individuals increasingly seek effective fitness solutions. This trend is driven by a growing awareness of the importance of maintaining a healthy lifestyle. In the UK, the fitness industry has seen a growth rate of approximately 5.5% annually, indicating a robust interest in health and wellness. As consumers become more health-conscious, they are turning to body composition analyzers to gain insights into their physical health metrics. This demand is further fueled by the rise of fitness influencers and social media platforms that promote fitness tracking. Consequently, the body composition-analyzers market is likely to expand as more individuals invest in personal health monitoring tools to achieve their fitness goals.

Rising Prevalence of Lifestyle Diseases

The increasing prevalence of lifestyle diseases in the UK is a critical driver for the body composition-analyzers market. Conditions such as obesity, diabetes, and cardiovascular diseases are on the rise, prompting individuals to seek proactive measures for health management. According to recent statistics, approximately 28% of adults in the UK are classified as obese, highlighting the urgent need for effective monitoring solutions. Body composition analyzers provide valuable insights into body fat percentage, muscle mass, and overall health, enabling users to make informed decisions regarding their lifestyle choices. As healthcare professionals recommend regular monitoring of body composition as part of disease prevention strategies, the market is poised for growth, catering to a population increasingly focused on health management.

Growing Interest in Preventive Healthcare

The body composition-analyzers market benefits from a growing interest in preventive healthcare among the UK population. As individuals become more aware of the long-term benefits of monitoring their health metrics, there is a shift towards proactive health management. Preventive healthcare emphasizes the importance of early detection and lifestyle modifications to avert potential health issues. This trend is reflected in the increasing sales of body composition analyzers, as consumers seek tools that provide comprehensive insights into their health status. The market is likely to expand as more people recognize the value of regular health assessments and the role of body composition analysis in achieving optimal health outcomes. This shift towards preventive measures is expected to sustain growth in the body composition-analyzers market.

Government Initiatives for Health Promotion

Government initiatives aimed at promoting health and wellness are significantly impacting the body composition-analyzers market. In the UK, various public health campaigns encourage citizens to adopt healthier lifestyles, which includes monitoring body composition. The National Health Service (NHS) has launched several programs focusing on obesity prevention and management, which indirectly boosts the demand for body composition analyzers. As these initiatives gain traction, the market is expected to benefit from increased awareness and accessibility of health monitoring tools. Furthermore, funding for health-related research and technology development may enhance the capabilities of body composition analyzers, making them more appealing to consumers. This supportive environment is likely to foster growth within the body composition-analyzers market.

Technological Advancements in Health Monitoring

Technological advancements are playing a pivotal role in shaping the body composition-analyzers market. Innovations in sensor technology, data analytics, and mobile applications are enhancing the functionality and user experience of these devices. For instance, the integration of Bluetooth and Wi-Fi capabilities allows users to sync their body composition data with smartphones, facilitating easier tracking and analysis. The UK market is witnessing a trend towards smart health devices, with an estimated growth rate of 7% in the wearable technology sector. As consumers become more tech-savvy, the demand for advanced body composition analyzers that offer real-time data and personalized insights is likely to increase. This technological evolution is expected to drive the body composition-analyzers market forward.