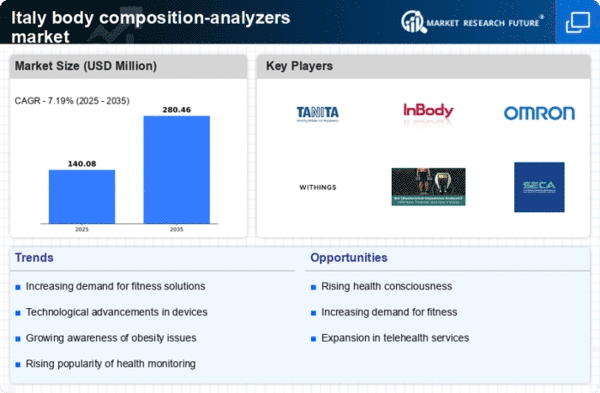

Increasing Demand for Fitness Solutions

The body composition-analyzers market in Italy is seeing a notable surge in demand for fitness solutions. This trend is largely driven by a growing awareness of health and wellness among the population. As more individuals seek to monitor their physical fitness and body metrics, the market for body composition analyzers is projected to expand. Recent data indicates that the fitness industry in Italy has seen a growth rate of approximately 5.5% annually, which correlates with the rising interest in personal health management. Consequently, fitness centers and personal trainers are increasingly incorporating body composition analyzers into their services, thereby enhancing their offerings and attracting more clients. This increasing demand for fitness solutions is likely to propel the body composition-analyzers market forward, as consumers prioritize their health and fitness goals.

Growing Interest in Preventive Healthcare

The growing interest in preventive healthcare is significantly impacting the body composition-analyzers market. As more individuals recognize the importance of preventing health issues before they arise, there is an increasing demand for tools that facilitate proactive health management. Body composition analyzers serve as essential devices for individuals aiming to maintain optimal health and prevent chronic diseases. In Italy, this trend is reflected in the rising number of health and wellness programs that encourage regular monitoring of body metrics. The market is projected to grow at a rate of around 6.5% as consumers invest in preventive healthcare solutions. This shift towards a preventive approach is likely to bolster the body composition-analyzers market, as individuals seek to take control of their health.

Technological Advancements in Health Monitoring

Technological advancements in health monitoring are playing a pivotal role in shaping the body composition-analyzers market. Innovations such as smart scales and mobile applications that sync with body composition analyzers are enhancing user experience and accessibility. These technologies allow consumers to track their body metrics conveniently and in real-time, fostering a more engaged approach to health management. In Italy, the integration of advanced technologies into health monitoring devices is expected to drive market growth, as consumers increasingly seek user-friendly and efficient solutions. The body composition-analyzers market could see a growth rate of approximately 7% as these technological advancements become more prevalent, making it easier for individuals to monitor their health and fitness levels.

Government Initiatives Promoting Health Awareness

Government initiatives aimed at promoting health awareness in Italy are significantly influencing the body composition-analyzers market. Various public health campaigns have been launched to encourage citizens to adopt healthier lifestyles, which includes regular monitoring of body composition metrics. These initiatives often emphasize the importance of understanding body fat, muscle mass, and overall health, thereby driving interest in body composition analyzers. For instance, the Italian Ministry of Health has implemented programs that provide resources and education on nutrition and physical activity. As a result, the market is likely to benefit from increased consumer engagement and investment in health-related technologies, with a projected growth rate of around 6% in the coming years. This governmental support is expected to create a favorable environment for the body composition-analyzers market.

Rising Prevalence of Obesity and Related Health Issues

The rising prevalence of obesity and related health issues in Italy is a critical driver for the body composition-analyzers market. Recent statistics reveal that approximately 30% of the Italian population is classified as overweight or obese, leading to an increased focus on health management solutions. As individuals seek to combat obesity and its associated health risks, the demand for body composition analyzers is likely to rise. These devices provide essential insights into body fat percentage, muscle mass, and overall health, enabling users to make informed decisions regarding their fitness and dietary habits. The body composition-analyzers market is expected to grow in response to this public health challenge, with an anticipated annual growth rate of 5% as more consumers prioritize their health and seek effective monitoring tools.