Growing Awareness of Vaccine Safety

There is a growing awareness among healthcare providers and consumers regarding the importance of vaccine safety in China. This awareness is driving the demand for reliable cold-chain monitoring systems to ensure that vaccines are stored and transported at the correct temperatures. The healthcare cold-chain-monitoring market is likely to benefit from this trend, as stakeholders recognize the critical role of temperature control in maintaining vaccine efficacy. With the increasing number of vaccination campaigns, the market is expected to see a rise in demand for advanced monitoring technologies, which could enhance the overall safety and effectiveness of immunization programs.

Rising Incidence of Chronic Diseases

The increasing prevalence of chronic diseases in China is contributing to the growth of the healthcare cold-chain-monitoring market. This growth is significant. As the demand for biologics and temperature-sensitive medications rises, healthcare providers are seeking efficient cold-chain solutions to manage these products effectively. Chronic diseases such as diabetes and cancer require consistent and reliable medication storage, which is facilitated by advanced cold-chain monitoring systems. The market is projected to expand as healthcare facilities invest in technologies that ensure the safe handling of these critical medical products, thereby improving patient outcomes.

Expansion of E-commerce in Pharmaceuticals

The rise of e-commerce platforms in the pharmaceutical sector is significantly impacting the healthcare cold-chain-monitoring market in China. This impact is notable. With the increasing trend of online pharmaceutical sales, there is a heightened need for effective cold-chain solutions to ensure the integrity of temperature-sensitive products during transit. E-commerce sales of pharmaceuticals are expected to reach $50 billion by 2026, necessitating robust cold-chain monitoring systems. This expansion presents a lucrative opportunity for market players to develop innovative solutions that cater to the specific needs of e-commerce logistics, thereby driving growth in the healthcare cold-chain-monitoring market.

Technological Innovations in Cold-Chain Solutions

Technological innovations are playing a pivotal role in shaping the healthcare cold-chain-monitoring market in China. The introduction of IoT-enabled devices and real-time monitoring systems is enhancing the efficiency and reliability of cold-chain logistics. These advancements allow for continuous temperature tracking and data analytics, which are essential for maintaining the integrity of temperature-sensitive products. As technology continues to evolve, the market is likely to witness increased adoption of smart cold-chain solutions, which could lead to improved operational efficiencies and reduced wastage in the healthcare sector.

Increasing Investment in Healthcare Infrastructure

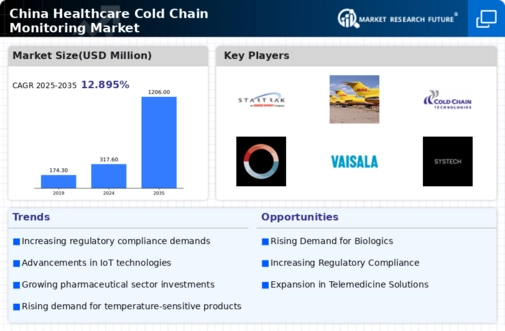

The healthcare cold-chain-monitoring market in China is experiencing a surge in investment. This investment is aimed at enhancing healthcare infrastructure. The Chinese government has allocated substantial funds to improve healthcare facilities, which includes the establishment of advanced cold-chain systems. This investment is crucial for ensuring the safe transportation and storage of temperature-sensitive medical products. As a result, the market is projected to grow at a CAGR of approximately 15% over the next five years. Enhanced infrastructure not only supports the distribution of vaccines and biologics but also strengthens the overall healthcare system, thereby driving demand for cold-chain monitoring solutions.