Government Initiatives and Policy Support

The Chinese government is actively promoting the home healthcare market through various initiatives and policy frameworks. Recent reforms aim to enhance the accessibility and affordability of healthcare services, particularly for the elderly and those with chronic illnesses. The introduction of subsidies and incentives for home healthcare providers is expected to stimulate market growth. Additionally, the government's focus on integrating home healthcare into the broader healthcare system indicates a long-term commitment to this sector. As a result, the home healthcare market is anticipated to expand, with projections suggesting a market value exceeding $100 billion by 2030. This supportive regulatory environment is crucial for fostering innovation and improving service delivery.

Shift Towards Patient-Centric Care Models

There is a notable shift towards patient-centric care models within the home healthcare market in China. This approach emphasizes personalized care plans tailored to individual patient needs, enhancing satisfaction and outcomes. As patients increasingly prefer receiving care in their homes, healthcare providers are adapting their services to meet these expectations. The rise of home healthcare agencies that specialize in customized care solutions is indicative of this trend. Market analysis suggests that patient-centric models could lead to a 15% increase in service utilization over the next few years. This evolution in care delivery not only benefits patients but also aligns with the broader goals of the healthcare system to improve quality and efficiency.

Growing Awareness of Preventive Healthcare

The growing awareness of preventive healthcare is significantly influencing the home healthcare market in China. As the population becomes more health-conscious, there is an increasing demand for services that focus on prevention rather than treatment. Home healthcare providers are responding by offering wellness programs, health education, and regular health screenings. This proactive approach is expected to reduce the incidence of chronic diseases and hospital admissions, thereby lowering overall healthcare costs. Market data indicates that preventive services could account for nearly 25% of the home healthcare market by 2027. This trend reflects a broader societal shift towards maintaining health and well-being, which is likely to drive sustained growth in the sector.

Rising Demand for Chronic Disease Management

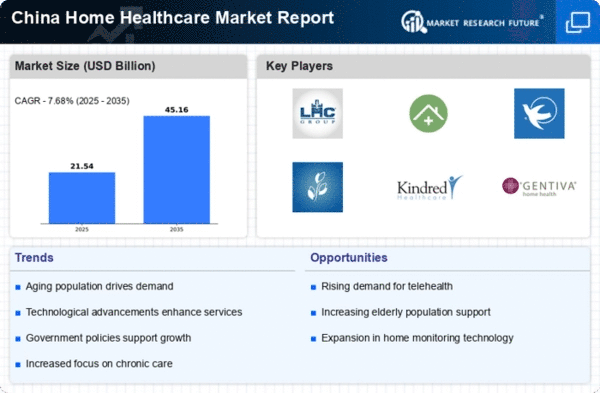

The increasing prevalence of chronic diseases in China is a pivotal driver for the home healthcare sector. With an estimated 300 million individuals suffering from chronic conditions, the need for effective management solutions is paramount. Home healthcare services provide personalized care, enabling patients to manage their conditions in a familiar environment. This trend is further supported by the Chinese government's initiatives to promote home-based care, which aim to alleviate the burden on hospitals. As a result, the home healthcare market is projected to grow significantly, with a compound annual growth rate (CAGR) of approximately 20% over the next five years. This growth reflects the market's potential to address the healthcare needs of an aging population while reducing healthcare costs.

Technological Advancements in Healthcare Delivery

Technological innovations are transforming the home healthcare market in China, enhancing service delivery and patient outcomes. The integration of telehealth, remote monitoring, and mobile health applications allows healthcare providers to offer real-time support to patients in their homes. This shift not only improves access to care but also empowers patients to take charge of their health. According to recent data, the telehealth segment is expected to account for over 30% of the home healthcare market by 2026. Furthermore, advancements in medical devices, such as wearable health monitors, are facilitating proactive health management. These technologies are likely to drive market growth by increasing the efficiency and effectiveness of home healthcare services.