Technological Innovations in Drug Formulation

Technological innovations in drug formulation are emerging as a critical driver for the nasal mucosa-drug-supply-device market. Advances in nanotechnology and biopharmaceuticals are enabling the development of more effective formulations that enhance drug stability and bioavailability. In China, research institutions and pharmaceutical companies are increasingly collaborating to create novel formulations tailored for nasal delivery, which could potentially increase the efficacy of treatments for various conditions. The market is projected to benefit from these innovations, with an anticipated growth of 10% annually as new products enter the market. As these technologies evolve, they are likely to transform the landscape of the nasal mucosa-drug-supply-device market, offering new opportunities for both manufacturers and healthcare providers.

Rising Investment in Healthcare Infrastructure

China's ongoing investment in healthcare infrastructure plays a pivotal role in shaping the nasal mucosa-drug-supply-device market. The government has committed substantial resources to enhance healthcare facilities, which includes the integration of advanced drug delivery technologies. This investment is expected to reach approximately $100 billion by 2026, facilitating the adoption of innovative nasal drug delivery devices. Enhanced healthcare infrastructure not only improves accessibility but also encourages the development and distribution of new products within the nasal mucosa-drug-supply-device market. As hospitals and clinics upgrade their facilities, the demand for effective and efficient drug delivery systems is likely to increase, thereby driving market growth. The focus on improving patient outcomes through better healthcare services further underscores the importance of this driver in the evolving landscape of the nasal mucosa-drug-supply-device market.

Growing Awareness of Nasal Drug Delivery Benefits

The increasing awareness among healthcare professionals and patients regarding the benefits of nasal drug delivery significantly influences the nasal mucosa-drug-supply-device market. Educational initiatives and marketing campaigns have effectively highlighted the advantages of this delivery method, such as rapid absorption and reduced systemic side effects. In China, the market is witnessing a shift as more practitioners advocate for nasal delivery systems, particularly for vaccines and medications targeting respiratory conditions. This growing awareness is likely to contribute to a market growth rate of around 12% over the next few years. As patients become more informed about their treatment options, the demand for nasal mucosa-drug-supply devices is expected to rise, further solidifying their role in modern therapeutic practices.

Increasing Demand for Non-Invasive Delivery Systems

The nasal mucosa-drug-supply-device market experiences a notable surge in demand for non-invasive drug delivery systems. This trend is primarily driven by the growing preference among patients for less painful and more convenient administration methods. In China, the market for non-invasive delivery systems is projected to expand significantly, with estimates suggesting a growth rate of approximately 15% annually. This shift towards non-invasive options is likely to enhance patient compliance and satisfaction, thereby fostering a more robust market environment. Furthermore, the increasing prevalence of respiratory diseases in the region necessitates innovative delivery systems that can effectively target the nasal mucosa, further propelling the market forward. As healthcare providers and patients alike recognize the benefits of these systems, the nasal mucosa-drug-supply-device market is poised for substantial growth in the coming years.

Regulatory Support for Innovative Drug Delivery Systems

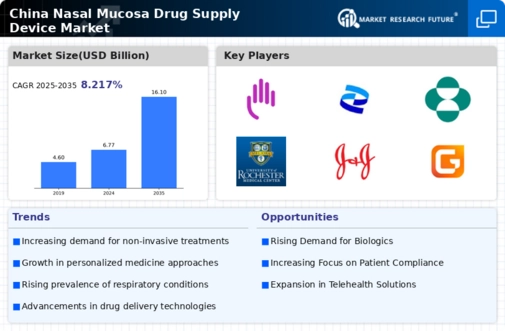

Regulatory support for innovative drug delivery systems is becoming increasingly influential in the nasal mucosa-drug-supply-device market. The Chinese government has implemented policies aimed at expediting the approval process for new medical devices, particularly those that demonstrate significant therapeutic advantages. This regulatory environment encourages manufacturers to invest in research and development, fostering innovation within the market. As a result, the nasal mucosa-drug-supply-device market is expected to see a compound annual growth rate (CAGR) of approximately 11% over the next five years. The proactive stance of regulatory bodies not only facilitates the introduction of new products but also enhances consumer confidence in the safety and efficacy of nasal drug delivery systems, thereby driving market expansion.