Rising Focus on Data Analytics

In the China pharmacy management system market, there is a growing emphasis on data analytics as pharmacies seek to leverage data for improved decision-making. The integration of advanced analytics tools within pharmacy management systems allows for better inventory control, customer insights, and operational efficiency. Recent studies indicate that pharmacies utilizing data analytics can reduce inventory costs by up to 20%, thereby enhancing profitability. This trend is likely to drive the demand for sophisticated pharmacy management systems that offer robust analytics capabilities. As pharmacies increasingly recognize the value of data-driven strategies, the adoption of such systems is expected to accelerate, further propelling the growth of the China pharmacy management system market.

Increasing Demand for Automation

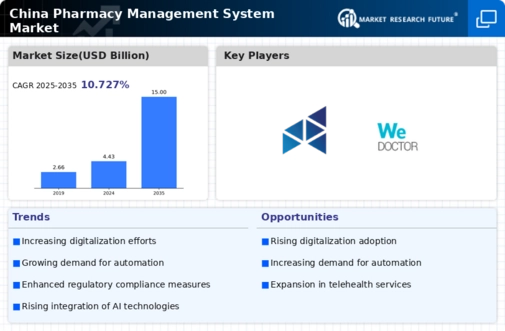

The China pharmacy management system market is experiencing a notable shift towards automation, driven by the need for efficiency and accuracy in pharmacy operations. As the healthcare sector evolves, pharmacies are increasingly adopting automated systems to streamline inventory management, prescription processing, and patient record keeping. According to recent data, the automation segment is projected to grow at a compound annual growth rate of approximately 15% over the next five years. This trend is likely to enhance operational efficiency, reduce human error, and improve overall service delivery in pharmacies across China. Consequently, the demand for advanced pharmacy management systems that incorporate automation features is expected to rise, positioning automation as a key driver in the China pharmacy management system market.

Shift Towards Patient-Centric Care

The China pharmacy management system market is witnessing a paradigm shift towards patient-centric care, which emphasizes personalized services and improved patient engagement. Pharmacies are increasingly adopting management systems that facilitate better communication with patients, enabling them to access their medication history, receive reminders for refills, and engage in health management. This trend aligns with the broader healthcare movement towards enhancing patient experiences and outcomes. As a result, pharmacy management systems that prioritize patient engagement features are likely to see increased adoption. The focus on patient-centric care is expected to drive innovation within the China pharmacy management system market, as pharmacies strive to meet the evolving needs of their clientele.

Government Initiatives and Policies

The China pharmacy management system market is significantly influenced by government initiatives aimed at enhancing healthcare delivery. The Chinese government has implemented various policies to promote the adoption of digital health technologies, including pharmacy management systems. For instance, the National Health Commission has introduced guidelines that encourage pharmacies to integrate electronic health records and digital prescription services. These initiatives are designed to improve patient safety and streamline healthcare processes. As a result, the market for pharmacy management systems is likely to expand, with an increasing number of pharmacies seeking compliance with these regulations. The government's commitment to digital transformation in healthcare is expected to bolster the growth of the China pharmacy management system market.

Integration of Telepharmacy Services

The integration of telepharmacy services is emerging as a significant driver in the China pharmacy management system market. With the increasing demand for remote healthcare services, pharmacies are adopting management systems that support telepharmacy functionalities. This allows pharmacists to provide consultations, medication management, and patient education remotely, thereby expanding their reach and improving access to pharmaceutical care. Recent data suggests that the telepharmacy segment is expected to grow by over 25% in the coming years, reflecting the rising acceptance of remote healthcare solutions. As pharmacies embrace telepharmacy, the demand for comprehensive pharmacy management systems that facilitate these services is likely to surge, further shaping the landscape of the China pharmacy management system market.