Increased Focus on Safety and Security

The growing emphasis on safety and security measures across various sectors is influencing the real time-location-system market in China. Industries such as healthcare, transportation, and public safety are increasingly utilizing location systems to monitor assets and personnel. For instance, hospitals are deploying these systems to track medical equipment and ensure patient safety. The market for safety-related applications is expected to expand, with estimates suggesting a growth rate of 12% annually through 2030. This focus on safety not only enhances operational efficiency but also drives the demand for innovative real time-location solutions.

Integration of AI and Machine Learning

The integration of artificial intelligence (AI) and machine learning technologies into real time-location systems is transforming the market landscape in China. These technologies enable predictive analytics and automated decision-making, enhancing the functionality of location systems. Businesses are increasingly leveraging AI to analyze location data, which can lead to improved operational strategies and customer experiences. The potential for AI-driven insights is vast, with the market for AI applications in location services projected to grow by 20% over the next five years. This integration is likely to propel the real time-location-system market to new heights.

Expansion of E-commerce and Retail Sectors

The rapid expansion of e-commerce and retail sectors in China is significantly contributing to the growth of the real time-location-system market. As online shopping continues to gain traction, retailers are adopting location systems to streamline logistics and enhance customer experiences. The market for location-based services in retail is expected to grow by 18% annually, driven by the need for efficient inventory management and personalized marketing strategies. This trend indicates a strong correlation between the growth of e-commerce and the demand for real time-location solutions, positioning the market for substantial growth in the coming years.

Rising Demand for Asset Tracking Solutions

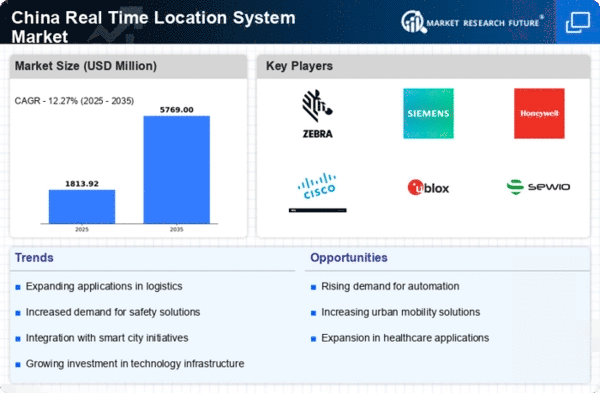

The increasing need for efficient asset management is driving the Real Time Location System Market in China. Industries such as manufacturing, logistics, and retail are adopting these systems to enhance operational efficiency. According to recent data, the asset tracking segment is projected to grow at a CAGR of 15% from 2025 to 2030. This growth is attributed to the need for real-time visibility of assets, which helps in reducing losses and improving inventory management. As companies seek to optimize their supply chains, the demand for advanced tracking solutions is likely to rise, thereby propelling the real time-location-system market forward.

Advancements in Wireless Communication Technologies

The evolution of wireless communication technologies, such as 5G, is significantly impacting the real time-location-system market in China. Enhanced connectivity allows for faster data transmission and improved accuracy in location tracking. With 5G networks expected to cover a substantial portion of urban areas by 2026, the potential for real-time applications is immense. This advancement enables businesses to implement more sophisticated location-based services, which can lead to increased customer engagement and operational efficiency. As a result, the real time-location-system market is likely to experience robust growth driven by these technological advancements.