Surge in Demand for Asset Tracking

The real time-location-system market experiences a notable surge in demand for asset tracking solutions across various sectors in the GCC. Industries such as logistics, manufacturing, and healthcare are increasingly adopting these systems to enhance operational efficiency. For instance, the logistics sector is projected to grow by approximately 15% annually, driven by the need for real-time visibility of assets. This trend indicates a shift towards more data-driven decision-making processes, where organizations leverage real-time data to optimize resource allocation and reduce operational costs. The integration of advanced technologies, such as IoT and AI, further enhances the capabilities of asset tracking systems, making them indispensable in the competitive landscape of the GCC.

Technological Advancements in RTLS

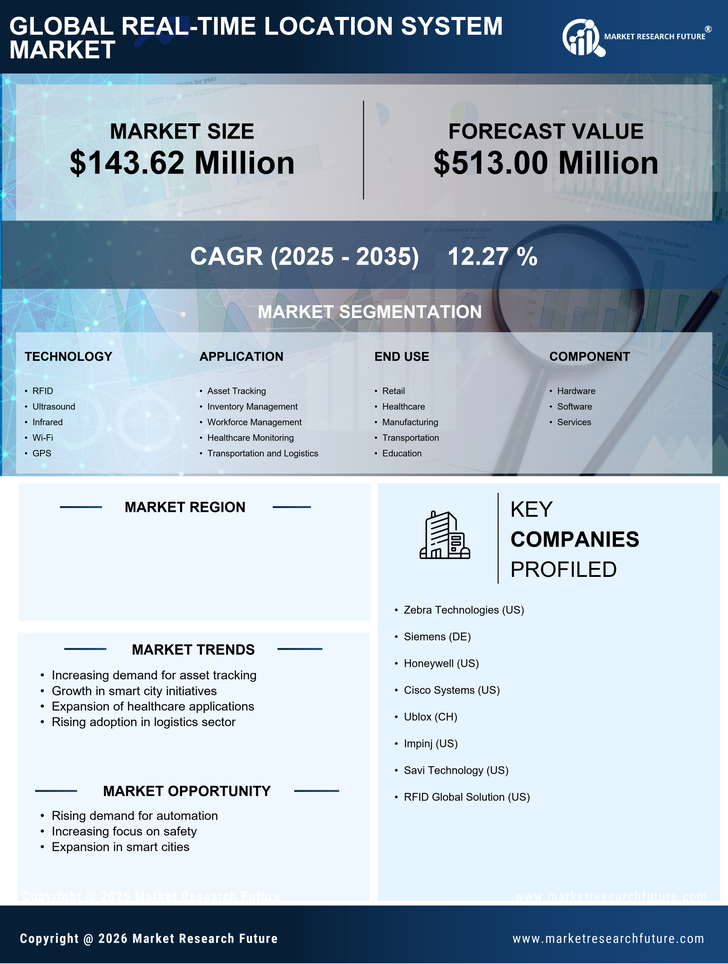

Technological advancements are a driving force behind the evolution of the real time-location-system market in the GCC. Innovations in wireless communication, sensor technologies, and data analytics are enhancing the functionality and efficiency of RTLS solutions. The introduction of ultra-wideband (UWB) technology, for instance, offers improved accuracy in location tracking, which is crucial for applications in healthcare and logistics. The market is expected to witness a compound annual growth rate (CAGR) of approximately 18% over the next five years, fueled by these technological breakthroughs. As organizations increasingly recognize the value of real-time data, the demand for sophisticated RTLS solutions is likely to escalate, positioning the GCC as a hub for technological innovation.

Government Initiatives and Regulations

Government initiatives and regulations play a pivotal role in shaping the real time-location-system market in the GCC. Various governments are actively promoting the adoption of advanced technologies to enhance public safety and improve urban management. For example, initiatives aimed at smart city development are encouraging the implementation of real-time tracking systems for public transportation and emergency services. The GCC region has seen investments exceeding $100 billion in smart city projects, which are expected to drive the demand for real-time location systems. These regulatory frameworks not only facilitate the growth of the market but also ensure compliance with safety and security standards, thereby fostering a conducive environment for innovation.

Growing Focus on Operational Efficiency

A growing focus on operational efficiency is reshaping the real time-location-system market in the GCC. Organizations are increasingly recognizing the importance of optimizing processes to reduce costs and enhance productivity. The implementation of real-time tracking systems allows businesses to monitor workflows, manage resources effectively, and identify bottlenecks in operations. This trend is particularly pronounced in sectors such as manufacturing and logistics, where efficiency gains can lead to substantial cost savings. Reports suggest that companies utilizing RTLS can achieve operational improvements of up to 30%, underscoring the potential benefits of these systems. As competition intensifies, the drive for operational excellence is likely to propel the adoption of real-time location systems across various industries.

Rising Need for Enhanced Security Solutions

The increasing need for enhanced security solutions significantly influences the real time-location-system market in the GCC. With the rise in urbanization and population density, security concerns have escalated, prompting organizations to seek advanced tracking systems. The market for security solutions is anticipated to grow by around 12% annually. This growth is due to businesses and governments prioritizing the safety of assets and individuals. Real-time location systems provide critical data that aids in monitoring and responding to security threats effectively. This trend is particularly evident in sectors such as retail and public safety, where the integration of location-based services is becoming essential for risk management and emergency response.