Rising Adoption in Retail Sector

The retail sector's growing adoption of real time-location systems is a key driver for the market. Retailers are increasingly utilizing these systems to enhance customer experience and streamline operations. By implementing location-based services, retailers can track customer movements, optimize store layouts, and manage inventory more effectively. This trend is evident as the retail segment is projected to account for over 30% of the market share by 2025. The ability to analyze customer behavior in real-time allows retailers to make informed decisions, ultimately leading to increased sales and customer satisfaction. As the retail landscape continues to evolve, the demand for real time-location systems is likely to expand, further solidifying its importance in the industry.

Emergence of Smart Cities Initiatives

The development of smart cities is significantly influencing the real time-location-system market. As urban areas evolve, there is a growing need for efficient management of resources and infrastructure. Real time-location systems play a crucial role in smart city initiatives by enabling real-time monitoring of public services, traffic management, and emergency response. The market is anticipated to benefit from government investments in smart city projects, which are expected to exceed $100 billion by 2025. This trend suggests that as cities become smarter, the demand for real time-location systems will increase, facilitating better urban planning and resource allocation. The integration of these systems into smart city frameworks indicates a transformative shift. This shift changes how urban environments are managed.

Increased Focus on Safety and Compliance

The heightened emphasis on safety and regulatory compliance is propelling the real time-location-system market. Industries such as healthcare and manufacturing are under pressure to adhere to strict safety standards and regulations. Real time-location systems provide a means to monitor compliance in real-time, ensuring that organizations meet safety protocols. This is particularly relevant in environments where tracking personnel and equipment is critical for safety. The market is expected to grow as companies invest in these systems to mitigate risks and enhance workplace safety. The integration of real time-location systems into safety protocols indicates a proactive approach to compliance, which is likely to drive further adoption across various sectors.

Growing Demand for Asset Tracking Solutions

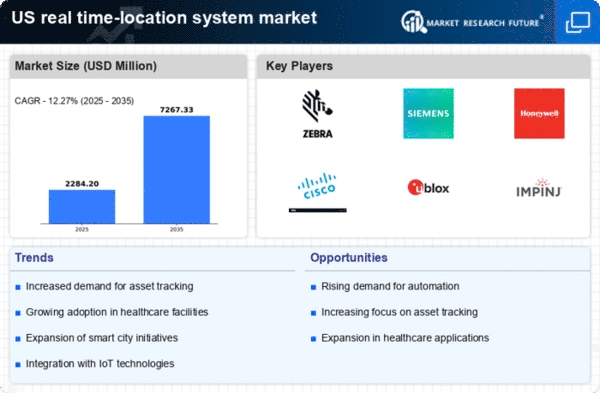

The increasing need for efficient asset management is driving the real time-location-system market. Organizations across various sectors, including manufacturing and logistics, are seeking solutions to monitor and manage their assets in real-time. This demand is reflected in the market, which is projected to reach approximately $10 billion by 2026, growing at a CAGR of around 20%. Companies are investing in real time-location systems to enhance operational efficiency, reduce losses, and improve inventory management. The ability to track assets in real-time not only minimizes downtime but also optimizes resource allocation, thereby contributing to overall productivity. As businesses recognize the value of these systems, the market is likely to witness sustained growth, indicating a robust trend towards asset tracking solutions.

Advancements in Wireless Communication Technologies

The evolution of wireless communication technologies is significantly impacting the real time-location-system market. Innovations such as 5G and advanced Wi-Fi protocols are enhancing the capabilities of location-based services. These technologies enable faster data transmission and improved connectivity, which are crucial for the effective functioning of real time-location systems. As a result, businesses are increasingly adopting these systems to leverage the benefits of real-time data analytics and location tracking. The market is projected to grow as organizations seek to integrate these advanced communication technologies into their operations. This trend suggests a promising future for the real time-location-system market, as enhanced connectivity leads to more efficient and reliable location services.

.png)