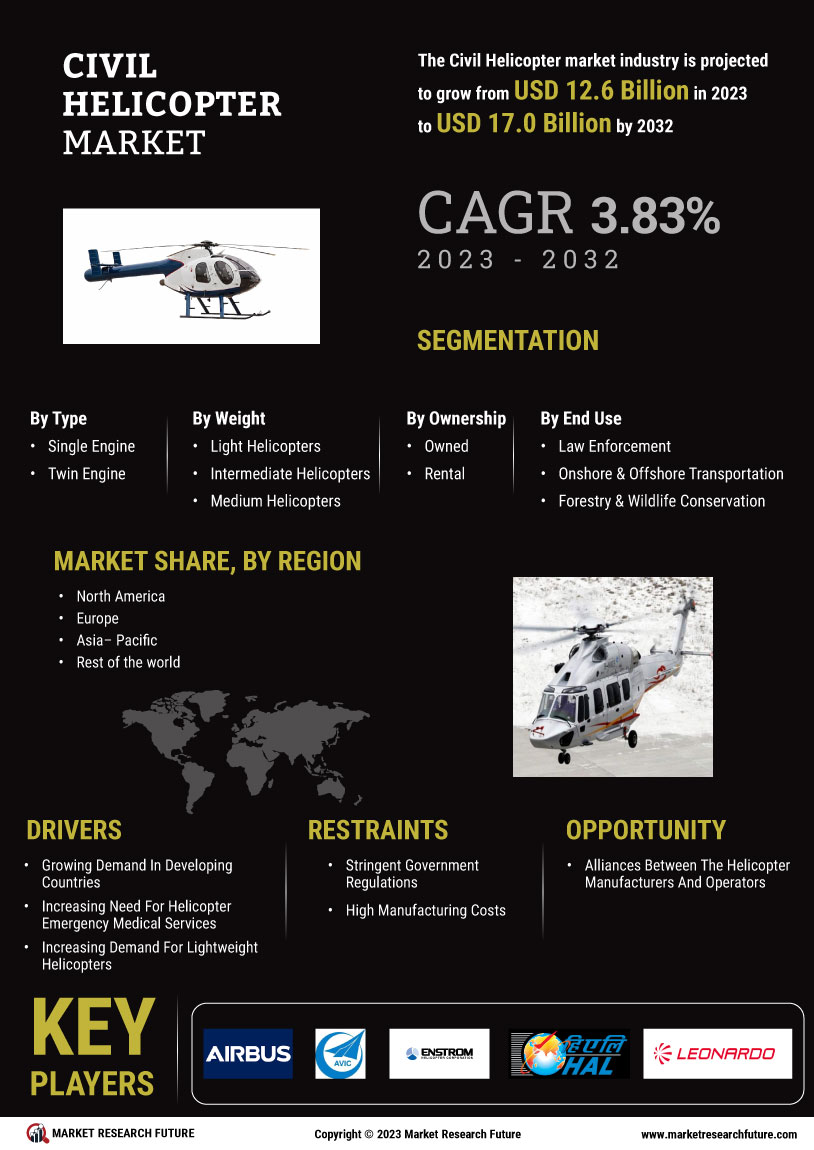

Civil Helicopter Market

In order to provide the most comprehensive study regarding the civil helicopter market, the research conducted follows a well-rounded methodological approach. The research methodology covers a combination of secondary and primary research, both quantitative and qualitative methods, and an in-depth analysis of the data collected from reliable sources. This methodology has been subdivided into four sections and is explained in further detail in the following subsections.

Secondary Research

Secondary research is the first phase of the research methodology. Extensive research is conducted using a range of sources such as industry and commercial databases, company annual reports, and published official documents. The secondary sources also include Bloomberg, Factiva, Thomson Reuters, Hoovers, etc., which provide the required financial and company information. Additionally, industry reports such as white papers were used to provide insights into the civil helicopter market.

Primary Research

The primary research helps to provide a deep understanding of the industry and market dynamics. To supplement the findings derived from secondary research, primary research was conducted. Primary research methods included interviews and industry-related surveys used to obtain insights into the study. Interview sessions were organized with the key players such as original equipment manufacturers (OEMs), distributors, aftermarket service providers, and other participants of the civil helicopter market to gain valuable information and insights.

Approaches Used

The research methodology used for the civil helicopter market includes a combination of bottom-up and top-down approaches. The bottom-up approach was used to give a more granular view of the data while the top-down approach provides a holistic view of the data and its related trends. Furthermore, Factor Analysis, Time-series Analysis, and Demand-side and Supply-side Data Triangulation were used to analyse the industry trends, market size, market dynamics, and market dynamics.

Data Analysis

The collected data is formulated under a descriptive statistical procedure. All sorts of data (primary and secondary) were arranged, reviewed, and analysed to establish a comprehensive view of the civil helicopter market with the help of Porter’s Five Force Model and SWOT Analysis. Through the help of this analysis, the researchers were able to understand the market trends, revenue growth trajectory, and competitive landscape.

Conclusion

Moreover, market dynamics such as drivers, restraints, opportunities, and challenges have been identified, which will provide a better assessment of the overall growth of the market. In addition, the data collected from primary and secondary sources was further validated by conducting multiple rounds of verification in order to ensure the accuracy and validity of data sources. Finally, a well-constructed market report was developed to provide comprehensive market insights to the readers along with the market forecast from 2023 to 2030.