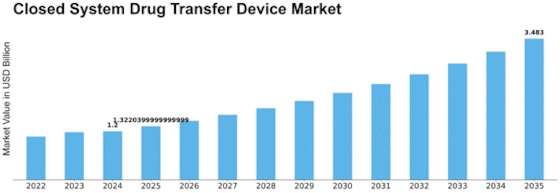

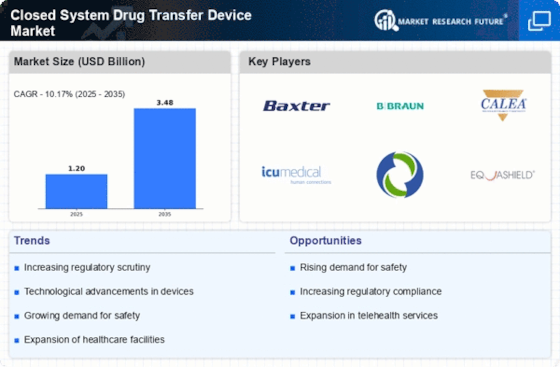

Closed System Drug Transfer Device Size

Closed System Drug Transfer Device Market Growth Projections and Opportunities

The growth of the closed system drug transfer device (CSTD) market is attributed to the Increasing use of hazardous drugs, oncology services and home healthcare are increasing the demand for CSTDS, and stringent regulatory requirements within the healthcare industry. However, the high initial setup costs are anticipated to hamper market growth. Nonetheless, it is anticipated that the Increasing investment in healthcare infrastructure presents a substantial opportunity for the global closed system drug transfer device (CSTD) market.

The increased use of dangerous drugs in the healthcare field is significantly influencing the way healthcare operates worldwide. According to the Centers for Disease Control and Prevention, around 8 million healthcare workers in the United States, including pharmacy and nursing staff, physicians, operating room workers, and others, face potential exposure to hazardous drugs. These drugs, crucial for treating chronic illnesses like cancer, have led to a rise in their use, creating a need for strong safety measures. In response, Closed System Drug Transfer Devices (CSTDs) have become a crucial solution. These devices create a sealed and airtight pathway, reducing the risk of exposure to toxic substances and protecting the well-being of healthcare workers, patients, and the environment.

One major factor driving the rapid adoption of CSTDs is the growing awareness of occupational safety issues. Increased understanding of the serious health risks linked to accidental exposure to hazardous drugs has led to the incorporation of these specialized devices as a vital protective measure throughout the healthcare system.

Healthcare authorities, such as the U.S. Food and Drug Administration (FDA), have implemented strict regulations requiring the use of CSTDs during the complex processes of preparing and administering hazardous drugs. This regulatory framework emphasizes the crucial role CSTDs play in minimizing exposure risks, establishing them as an indispensable component of modern healthcare practices. As awareness of safety protocols continues to rise and chronic diseases become more prevalent, the integration of CSTDs into the standard operating procedures of healthcare facilities worldwide is accelerating. Consequently, the global CSTD market is experiencing a strong increase in demand. This demand is driven by the unwavering need to ensure the secure and responsible handling of hazardous drugs in a healthcare environment that prioritizes the well-being of both patients and healthcare professionals.

Leave a Comment