Top Industry Leaders in the CNC Cutting Machines Market

*Disclaimer: List of key companies in no particular order

Top listed global companies in the industry are:

- Biesse Group

- HOMAG Group

- Anderson Group

- MES Inc.

- MultiCam Inc.

- Thermwood Corporation

- The Shoda Company

- ShopSabre

- AXYZ Automation Group

- DMG MORI

- KOMO Machine Inc.

- TRUMPF, among others

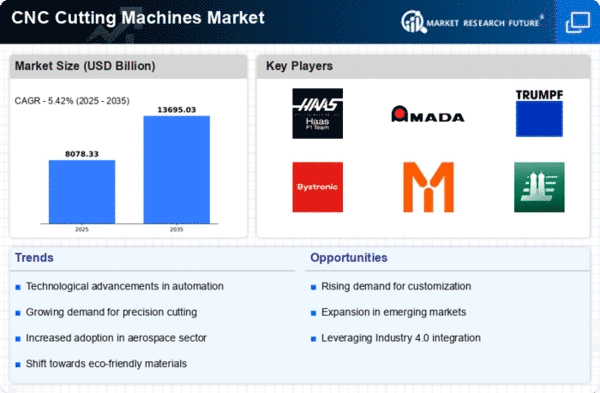

Navigating the Maze: Competitive Landscape of the CNC Cutting Machines Market

The CNC cutting machines market, fueled by automation and diverse machining needs, presents a complex and dynamic landscape. Understanding the strategies adopted by key players, factors influencing market share, and emerging trends is crucial for navigating this intricate maze and securing a competitive edge.

Key Players and their Strategies:

- Global Titans: Established players like DMG MORI and Mazak leverage their extensive product portfolios, brand recognition, and global footprints to cater to a broad range of industries. DMG MORI offers various high-performance milling and turning machines, while Mazak excels in multi-tasking machines for complex workpieces.

- Regional Specialists: Companies like Yamazaki Mazak Corporation and Shenyang Machine Tool Group excel in specific regions by tailoring solutions to local regulations and manufacturing demands. Yamazaki Mazak caters to Asian markets with cost-effective options, while Shenyang Machine Tool Group dominates China with state-backed support.

- Agile Innovators: Startups like Hyperganic Industries and GROOVI disrupt the market with innovative approaches. Hyperganic focuses on generative design and robotic machining for increased automation, while GROOVI offers compact and user-friendly CNC mills for small workshops.

Factors for Market Share Analysis:

- Technological Prowess: Offering advanced cutting technologies like lasers, water jets, and high-speed spindles allows players to address diverse material needs and achieve complex machining tasks. DMG MORI's laser cutting machines cater to intricate metal geometries, while Mazak's multi-tasking machines handle multiple processing steps efficiently.

- Industry Expertise: Deep understanding of specific industries like aerospace, automotive, and medical facilitates tailoring solutions and addressing unique machining challenges. Mazak's expertise in aerospace manufacturing is a prime example.

- Cost-Effectiveness and ROI: Balancing advanced features with affordability is crucial, especially in budget-conscious segments. Yamazaki Mazak's cost-effective machines have propelled their market share in emerging economies.

- Service and Support Network: Offering readily available spare parts, prompt technical assistance, and training programs fosters customer loyalty and brand preference. DMG MORI's extensive service network strengthens its market position.

Emerging Trends and Company Strategies:

- Digitalization and Smart Manufacturing: Integrating sensors, data analytics, and AI into machines enables real-time performance monitoring, predictive maintenance, and optimized machining parameters. Hyperganic's cloud-based data platform exemplifies this trend.

- Additive Manufacturing Integration: Combining CNC cutting with 3D printing capabilities allows for hybrid manufacturing of complex parts, a trend being explored by GROOVI and DMG MORI.

- Focus on Sustainability: Minimizing energy consumption and utilizing eco-friendly coolants are gaining traction. Manufacturing machines with energy-efficient features and promoting sustainable practices resonate with environmentally conscious customers.

- Industry-Specific Solutions: Targeting high-growth segments like medical device manufacturing and electronics with specialized machines and expertise is a growing trend. Mazak's medical machining solutions showcase this approach.

Overall Competitive Scenario:

The CNC cutting machines market is a fiercely contested arena where traditional giants face challenges from regional players and innovative startups. Success hinges on continuous innovation, a diversified product portfolio, and adaptability to emerging trends. Companies prioritizing digitalization, industry-specific solutions, and sustainability hold a strong position in this dynamic landscape.

Latest Company Updates:

October 2023- During a technology open house at its regional application center in Moncks Corner, S.C., Absolute Haitian announced it would now sell Haitian Group machine tools and die-casting machines into the U.S. China's Haitian Group has used its overseas subsidiaries and representatives to bring equipment from its five divisions — injection molding, metal cutting, drives, die casting, industry 4.0 — all around the globe over the years. Typically, new offerings are launched domestically in China and exported into new markets from there, arriving in Europe and the U.S. last. Glenn Frohring, owner of Absolute Haitian, said Haitian has been building CNC machines since 2005, growing the business cautiously and deliberately and entering new markets along the way, a tactic they've used for other business units.

Frohring said that Europe and the U.S. will be the last markets entered. He further added that by the time the company gets it, the technology is all proven with any bugs worked out. The metal cutting business, Haitian Precision, markets the Hision line of CNC machine tools, including gantry, vertical, horizontal, and lathe machines. In South Carolina, Absolute Haitian showcased a vertical machining center and CNC lathe. Haitian started in the die casting business in 2016, leaning on its expertise in platen manufacture and design to enter the market, which has grown in recent years, propelled in large part by new applications with the electric and battery electric vehicle market. Ben Hartigan, Absolute Haitian's marketing coordinator, said the company can make systems as large as 8,800 tons. In S.C., the company showcased an HDC 550 Plus machine with a clamping force of 560 tons. The machines have been sold in Mexico for the last four years, with roughly 65 systems installed.