Coffee Size

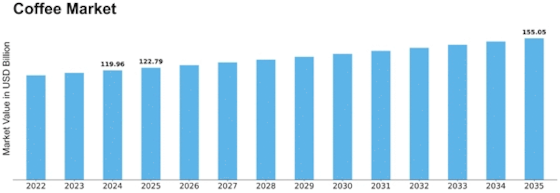

Coffee Market Growth Projections and Opportunities

The coffee market is a dynamic and globally influential industry, with numerous factors shaping its trends and growth. One of the primary drivers is the pervasive cultural and social role that coffee plays in people's lives. Coffee has transcended its status as a mere beverage and become a lifestyle choice for many consumers. The global coffee culture, with its emphasis on specialty blends, artisanal brewing methods, and coffee shop experiences, has significantly impacted the market. As a result, consumer preferences are increasingly gravitating towards high-quality, ethically sourced, and diverse coffee options.

Economic factors wield substantial influence over the coffee market. The economic conditions of coffee-producing countries, which often fall within the developing world, play a crucial role in determining the overall supply chain dynamics. Fluctuations in currency exchange rates, labor costs, and weather conditions in coffee-growing regions can affect production levels and subsequently impact global coffee prices. Economic stability in both coffee-producing and consuming nations is integral to sustaining a healthy coffee market.

Climate change is emerging as a significant factor affecting the coffee market. Coffee is a sensitive crop, and variations in temperature and precipitation patterns can impact yields and quality. The increasing prevalence of pests and diseases in coffee plantations, exacerbated by climate change, poses challenges to coffee farmers. Sustainable and climate-resilient practices are becoming essential in the coffee industry to ensure the long-term viability of coffee production.

Technological advancements are reshaping the coffee market, from production to consumption. Innovations in coffee farming techniques, such as precision agriculture and smart farming, contribute to higher yields and improved quality. On the consumer end, technology plays a role in enhancing the coffee experience, with coffee machines, brewing equipment, and mobile apps for ordering and customization becoming integral to the modern coffee culture.

Consumer health trends and preferences are influencing the coffee market. With a growing awareness of health and wellness, there is a demand for functional and healthier coffee options. This has led to the rise of specialty coffees, including organic, fair trade, and low-acid varieties. Additionally, the surge in popularity of plant-based milk alternatives has influenced coffee consumption habits, with many consumers opting for non-dairy options.

The competitive landscape within the coffee market is intense, with both global conglomerates and artisanal coffee roasters vying for market share. Branding, marketing strategies, and the ability to offer unique and differentiated products are crucial in this competitive environment. Coffee companies that can convey a compelling brand story, emphasize sustainability, and connect with consumers on a personal level are often more successful in capturing and retaining customers.

Government policies and regulations also impact the coffee market. From trade agreements and tariffs to environmental regulations and labeling standards, the coffee industry must navigate a complex regulatory landscape. Additionally, initiatives promoting sustainable and ethical coffee production, such as certification programs, influence consumer choices and can shape the overall market trends.

Leave a Comment