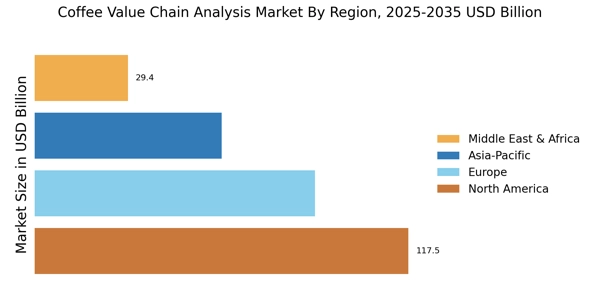

North America : Coffee Consumption Leader

North America is the largest market for coffee value chain analysis, holding approximately 40% of the global market share. The region's growth is driven by increasing consumer demand for specialty coffee and sustainable sourcing practices. Regulatory support for fair trade and organic certifications further catalyzes market expansion, encouraging consumers to opt for ethically sourced products. The trend towards premiumization in coffee consumption is also a significant driver of growth.

The United States and Canada are the leading countries in this region, with the U.S. accounting for the majority of the market share. Major players like Starbucks, Dunkin', and Peet's Coffee dominate the competitive landscape, focusing on innovation and customer experience. The presence of established brands and a growing number of artisanal coffee shops contribute to a vibrant market environment, fostering healthy competition and diverse offerings.

Europe : Emerging Coffee Innovations

Europe is the second-largest market for coffee value chain analysis, holding around 30% of the global market share. The region is characterized by a strong emphasis on sustainability and quality, with consumers increasingly favoring organic and fair-trade coffee. Regulatory frameworks, such as the EU's Green Deal, promote sustainable agricultural practices, which are pivotal in shaping market dynamics. The growing trend of coffee consumption at home, especially post-pandemic, has also fueled demand for premium coffee products.

Leading countries in Europe include Germany, Italy, and France, with Germany being the largest market. Key players like Lavazza, Illy, and JDE Peet's are actively innovating to meet consumer preferences. The competitive landscape is marked by a mix of traditional coffee brands and new entrants focusing on specialty coffee. The presence of diverse coffee cultures across countries further enriches the market, driving innovation and variety in product offerings.

Asia-Pacific : Rapidly Growing Coffee Market

Asia-Pacific is witnessing rapid growth in the coffee value chain analysis market, accounting for approximately 20% of the global market share. The region's growth is fueled by changing consumer preferences, with younger populations increasingly gravitating towards coffee consumption. The rise of coffee culture, particularly in countries like China and India, is supported by urbanization and a growing middle class. Regulatory initiatives promoting sustainable farming practices are also contributing to market growth, enhancing the appeal of locally sourced coffee.

Countries like China, Japan, and Australia are leading the charge in this region. The competitive landscape is evolving, with both international brands and local players vying for market share. Key players such as Nestle and Kraft Heinz are expanding their presence, while local brands are innovating to cater to regional tastes. The increasing availability of specialty coffee shops and cafes is further driving consumer interest and market expansion.

Middle East and Africa : Untapped Coffee Potential

The Middle East and Africa region is an emerging powerhouse in the coffee value chain analysis market, holding about 10% of the global market share. The growth is driven by increasing coffee consumption, particularly in countries like Ethiopia and Kenya, where coffee is a cultural staple. Regulatory support for coffee farmers and initiatives aimed at improving quality and sustainability are key drivers of market growth. The region's unique coffee heritage and the rise of specialty coffee are also contributing to its expanding market presence.

Leading countries include Ethiopia, Kenya, and South Africa, with Ethiopia being the birthplace of coffee. The competitive landscape is characterized by a mix of local producers and international brands. Key players like Tchibo and Lavazza are investing in the region, recognizing its potential for growth. The increasing interest in coffee tourism and local coffee experiences is further enhancing market dynamics, making it an exciting area for investment and development.