Rising Demand for Road Maintenance

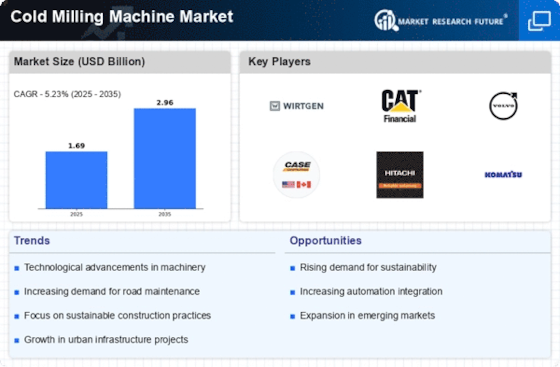

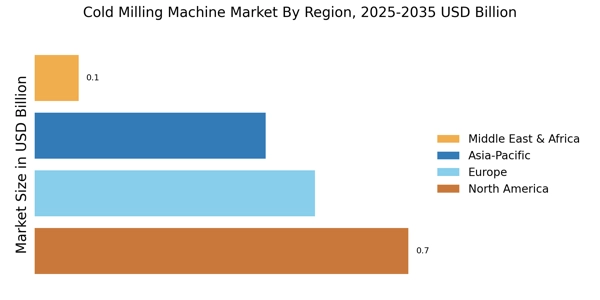

The Cold Milling Machine Market is experiencing a notable increase in demand for road maintenance activities. As urbanization accelerates, the need for maintaining and upgrading existing road infrastructure becomes paramount. This trend is further supported by government initiatives aimed at enhancing transportation networks. In many regions, the aging road infrastructure necessitates regular maintenance, which often involves cold milling processes to ensure surface quality and longevity. According to recent data, the road maintenance sector is projected to grow at a compound annual growth rate of approximately 5% over the next few years, indicating a robust market for cold milling machines. This growth is likely to drive investments in advanced milling technologies, thereby enhancing operational efficiency and reducing costs.

Focus on Sustainable Construction Practices

Sustainability is becoming a central theme in the Cold Milling Machine Market. As environmental concerns gain prominence, construction practices are evolving to incorporate more sustainable methods. Cold milling is recognized for its ability to recycle existing materials, thereby reducing waste and minimizing the carbon footprint associated with road construction. The process allows for the reuse of milled asphalt, which can be reintroduced into new asphalt mixtures. This recycling capability aligns with global sustainability goals and is likely to drive demand for cold milling machines. Market analysts suggest that the emphasis on sustainable construction could lead to a growth rate of approximately 4% in the cold milling sector, as more companies adopt eco-friendly practices.

Growing Demand for High-Performance Machinery

The Cold Milling Machine Market is witnessing a growing demand for high-performance machinery that can deliver superior results in various milling applications. As construction projects become more complex, the need for machines that can operate efficiently under diverse conditions is paramount. High-performance cold milling machines are designed to handle a range of materials and provide precise milling depths, which is essential for achieving optimal surface quality. Recent market analyses indicate that the demand for such advanced machinery is expected to increase by around 7% in the coming years. This trend reflects a broader industry shift towards investing in equipment that enhances productivity and reduces downtime, ultimately contributing to the overall growth of the cold milling machine market.

Technological Innovations in Milling Equipment

Technological advancements play a crucial role in shaping the Cold Milling Machine Market. The introduction of sophisticated milling machines equipped with advanced features such as GPS technology, automated controls, and improved cutting tools has revolutionized the milling process. These innovations not only enhance precision and efficiency but also reduce operational costs. For instance, machines that utilize intelligent control systems can optimize milling depth and speed, leading to better material utilization. The market for these technologically advanced machines is expected to expand significantly, with estimates suggesting a growth rate of around 6% annually. This trend indicates a shift towards more efficient and environmentally friendly milling solutions, aligning with broader industry goals.

Increased Investment in Infrastructure Projects

The Cold Milling Machine Market is significantly influenced by increased investment in infrastructure projects. Governments and private entities are allocating substantial budgets towards the development and rehabilitation of transportation networks, including roads and highways. This surge in infrastructure spending is driven by the need to support economic growth and improve connectivity. Recent reports indicate that infrastructure investment is expected to reach unprecedented levels, with estimates suggesting a rise of over 10% in certain regions. Such investments create a favorable environment for the cold milling machine market, as these machines are essential for preparing surfaces for new asphalt layers and ensuring the durability of roadways. Consequently, the demand for cold milling machines is likely to see a corresponding increase.