Top Industry Leaders in the Commercial Aircraft Aftermarket Parts Market

Two new digital products for the aftermarket were introduced in 2023 by Asia Digital Engineering (ADE), the maintenance division of Capital A, the parent company of AirAsia. The items are designed to address problems with the acquisition of aviation parts and the control of aircraft health. ADE has introduced Aerotrade, an aviation marketplace created to alleviate the problems faced by airlines in the parts procurement process. The platform has inventory valued at over $120 million, which consists of parts for both Boeing and Airbus aircraft. The platform is the first of its sort in Asia, according to ADE.

The acquisition of MB Aerospace ("MB") has reached a definitive agreement, as announced by Barnes Group Inc. in 2023. With an enterprise value of about $740 million, MB Aerospace is a prominent supplier of precision aero-engine component manufacture and repair services, catering to Tier 1 suppliers, MRO providers, and major aerospace and defence engine OEMs. It is anticipated that the acquisition will close in 2023's fourth quarter, pending regulatory clearances and other usual closing requirements being met.

HEICO Corporation announced today, 2023, that it has entered into an agreement to purchase Wencor Group ("Wencor") from Warburg Pincus LLC affiliates and Wencor's management for a total of $2.05 billion, which will be paid at closing in the form of $150 million in HEICO Class A Common Stock1 and $1.9 billion in cash.

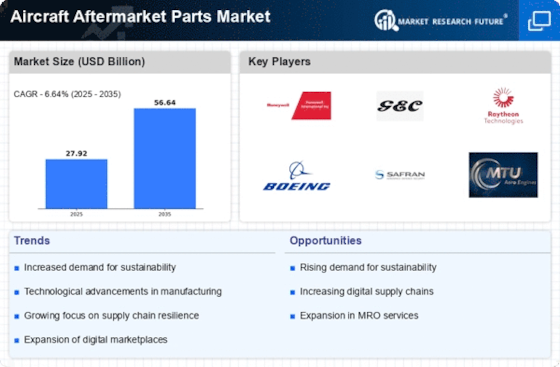

Key Companies Aircraft Aftermarket Parts Market

- AAR (US)

- Walter Aviation Limited (UK)

- Eaton (Ireland)

- Parker Hannifin Corporation (US)

- Aviall (US)

- Kellstrom Aerospace (US)

- General Electric (US)

- Honeywell International Inc. (US)

- Meggitt PLC (England)

- Collins Aerospace (US)