Increasing Vehicle Age

The average age of vehicles on the road in the US has been steadily increasing, currently estimated at over 12 years. This trend suggests that consumers are more likely to seek aftermarket automotive parts to maintain and repair older vehicles. As the US Aftermarket Automotive Parts Component Market adapts to this demographic shift, it is likely to see a surge in demand for components that cater to aging vehicles. This includes parts such as brake pads, filters, and batteries, which are essential for vehicle upkeep. The growing preference for cost-effective repairs over new vehicle purchases further fuels this trend, indicating a robust market potential for aftermarket suppliers.

Growth in Vehicle Ownership

The increasing rate of vehicle ownership in the US is a pivotal driver for the aftermarket automotive parts sector. As more households acquire vehicles, the demand for maintenance and repair services rises correspondingly. The US Aftermarket Automotive Parts Component Market is poised to benefit from this trend, with projections indicating that vehicle ownership could reach 300 million by 2026. This growth translates into a larger customer base for aftermarket parts, as vehicle owners seek reliable and affordable solutions for repairs. Additionally, the trend towards DIY repairs among consumers further amplifies the demand for aftermarket components, creating a vibrant market environment.

Regulatory Changes and Compliance

The US automotive industry is subject to various regulations that impact the aftermarket parts sector. Recent changes in environmental regulations, particularly concerning emissions and safety standards, have prompted manufacturers to innovate and comply with new requirements. The US Aftermarket Automotive Parts Component Market must navigate these regulatory landscapes, which can create both challenges and opportunities. For instance, the demand for eco-friendly parts is likely to rise as consumers become more environmentally conscious. Compliance with these regulations not only ensures market access but also enhances brand reputation, potentially leading to increased sales in a competitive market.

Expansion of Online Retail Platforms

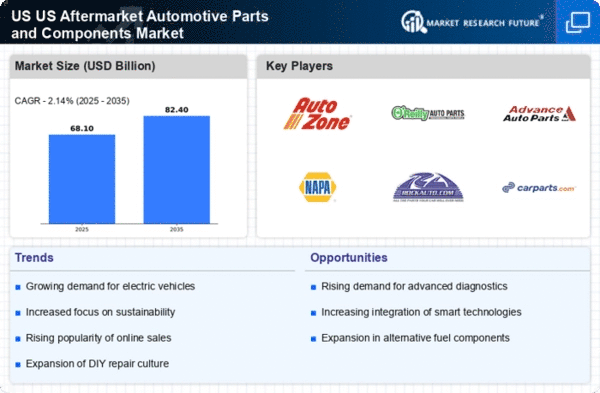

The proliferation of e-commerce has transformed the way consumers purchase automotive parts in the US. The US Aftermarket Automotive Parts Component Market is witnessing a significant shift towards online sales channels, with platforms like Amazon and specialized automotive websites gaining traction. This transition is supported by data indicating that online sales of automotive parts have increased by over 20% in recent years. The convenience of online shopping, coupled with competitive pricing and extensive product availability, appeals to a broad consumer base. As more consumers opt for online purchases, traditional brick-and-mortar retailers are compelled to adapt their strategies, further shaping the market landscape.

Rising Consumer Preference for Customization

In recent years, there has been a notable shift in consumer behavior towards vehicle customization. The US Aftermarket Automotive Parts Component Market is experiencing growth as consumers seek to personalize their vehicles for aesthetic appeal and performance enhancement. This trend is particularly evident among younger demographics, who are more inclined to invest in aftermarket modifications. The market for performance parts, such as exhaust systems and suspension kits, is expanding, with estimates suggesting a growth rate of approximately 5% annually. This consumer inclination towards customization not only drives sales but also encourages innovation among manufacturers, leading to a diverse range of products.