On March 12, 2024, Lufthansa Technik made an announcement concerning a partnership with GE Aerospace with the aim of self-accomplishing MRO services for engines. This collaboration emphasizes the next generation of aircraft engines which are more effective considering the requirement of aftermarket services.

In February 2024, Collins Aerospace built an AI and ML-based platform that augments predicting maintenance on aviation tools. This assists airlines' in predicting the failure of critical parts and consequently adjusting their repurchasing timing, thus minimizing costs and idling.

In January 2024, Honeywell Aerospace introduced a digital aftermarket service designed to improve the management of the business offering life cycle maintenance and support for the aircraft. The service works with Honeywell Forge making it easier for airlines to reduce the fuel consumption and further improve the maintenance cycle.

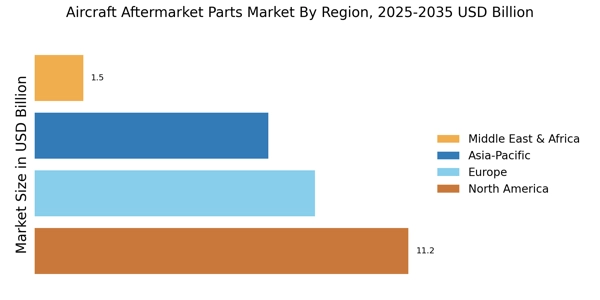

In December 2023, Airbus announced the construction of a new state of the art MRO facility FG9254775 parts distribution center in Singapore. The center is positioned to service A320 and A350 aircraft, in response to the increasing demand for aviation’s maintenance services in the Asia-Pacific region.

In November 2023, The Boeing company announced the acquisition of a logistics center in Dubai, as an effort to broaden the distribution of its parts for aircraft through Boeing Global Services. This ensures easy accessibility to spares for airlines in the Middle East and Africa where the focus is on bolstering the Boeing presence.

In October 2023, AAR Corporation entered into a multi-year fleet contracts with Air India for Aircraft Component Repair Services and Parts for their Air India fleet.

In September 2023, the European Union Aviation Safety Agency (EASA) renewed amendments that will ease the processes involved in the certification of parts for aircraft. Such changes are likely to enhance the supply of aftermarket parts which is necessary for the industry to rebound after the pandemic.

In August 2023, Delta TechOps reported that there has been a big increasing in the demand for MRO services aided the return of flying. During this period, the firm disclosed its intention to recruit and expand its capacity to meet the ripening aftermarket needs

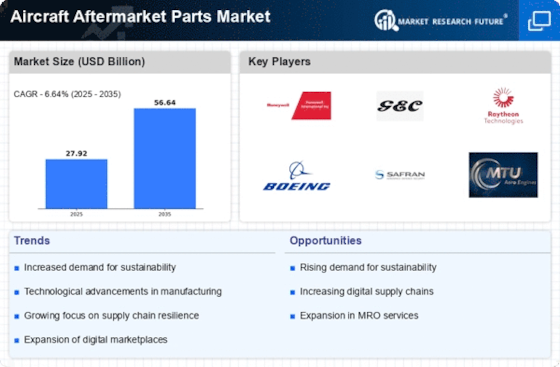

Manufacturing locally to minimize operational costs is one of the key business tactics manufacturer use in the aircraft aftermarket parts market industry to benefit clients and increase the market sector. In recent years, the aircraft aftermarket parts market industry has offered some of the most significant technological advancements. Major players in the aircraft aftermarket parts market, including AAR (US), J.

Walter Aviation Limited (UK), Eaton (Ireland), Parker Hannifin Corporation (US), Aviall (US), Kellstrom Aerospace (US), General Electric (US), Honeywell International Inc. (US), Meggitt PLC (England), Collins Aerospace (US), and others, are attempting to increase market demand by investing in research and development operations.

AAR is a multinational provider of aftermarket services for the aerospace and defense industries in more than 20 nations. Aviation Services and Expeditionary Services are two of AAR's business divisions that help both commercial and government clients. Maintenance, Repair, and Overhaul (MRO) Services, Original Equipment Manufacturer (OEM) Solutions, Integrated Solutions, and Parts Supply are all a part of AAR's Aviation Services. The management of Mobility Systems is a part of AAR's Expeditionary Services. Our aftermarket knowledge and innovative solutions have won multiple awards and are helping businesses save money without sacrificing quality or safety.

In March 2023, AAR CORP, a major service provider for the aviation industry, signed a distribution deal with Cloud Cap Technology, a division of Collins Aerospace Mission Systems. Built on AAR's civil and government ties, as well as its proven supply chain and sales support systems, this arrangement increases AAR's footprint in the Unmanned Aerial System (UAS) sector.

Parker Meggitt uses its years of experience to improve the world. Our organization comprises some of the world's smartest minds, and we all work together to create cutting-edge technology and solutions with the ultimate objective of resolving the world's most pressing technical problems. Parker Aerospace Group successfully acquired Meggitt PLC, a leader in the aerospace, defense, and energy industries, and merged it with Parker Meggitt. Throughout its 37 manufacturing plants and regional offices, Parker Meggitt employs more than 9,000 employees.

In March 2023, Parker Meggitt, a division of Parker Hannifin Corporation, the world's foremost provider of motion and control technology, announced a collaboration with Airbus to create an energy buffer ("buffer") in service of the ZEROe aircraft demonstration.

Key Companies in the Aircraft Aftermarket Parts Market include.

- AAR (US)

- Walter Aviation Limited (UK)

- Eaton (Ireland)

- Parker Hannifin Corporation (US)

- Aviall (US)

- Kellstrom Aerospace (US)

- General Electric (US)

- Honeywell International Inc. (US)

- Meggitt PLC (England)

- Collins Aerospace (US)

Aircraft Aftermarket Parts Market Industry Developments

For Instance, April 2023 GE has introduced further emission reduction technology options for its LM25000XPRESS aero-derivative fleet worldwide following a successful installation of gas turbines in Colorado.

For Instance, March 2023 Collins Aerospace introduced the Powered by Collins Initiative, which encourages technological innovation among Deep Tech M&Es. The program, announced at the South by Southwest Conference, is designed to help Collins and Deep Tech companies work together on cutting-edge technologies so that new products and services may be brought to market more quickly in the aerospace sector.

For Instance, March 2023 Pratt & Whitney Canada (P&WC), a division of Pratt & Whitney, announced that it had signed an agreement with helicopter distributor Rotortrade to increase the number of helicopter engines enrolled annually in the Certified Pre-Owned (CPO) Engine Program.