Regulatory Changes

The United States Car Parts Aftermarket Market is also shaped by evolving regulatory frameworks aimed at enhancing vehicle safety and environmental standards. Recent legislation has introduced stricter emissions regulations, compelling manufacturers to produce more eco-friendly parts. This shift not only aligns with consumer preferences for sustainable products but also opens new avenues for innovation within the aftermarket sector. Companies that adapt to these regulations by offering compliant parts are likely to gain a competitive edge. Moreover, the increasing focus on safety features in vehicles is driving demand for high-quality replacement parts. As regulations continue to evolve, the aftermarket is expected to adapt, potentially leading to a more diverse range of products that meet both safety and environmental criteria.

Technological Advancements

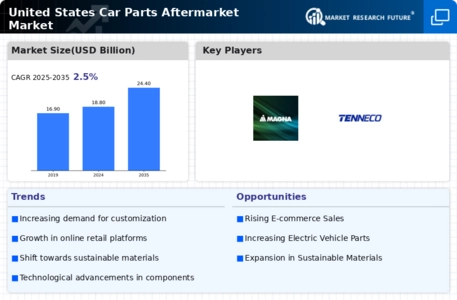

The United States Car Parts Aftermarket Market is experiencing a notable transformation due to rapid technological advancements. Innovations such as 3D printing and advanced materials are revolutionizing the production of car parts, allowing for more efficient manufacturing processes. This shift not only reduces costs but also enhances the customization of parts, catering to specific consumer needs. Furthermore, the integration of artificial intelligence in inventory management and supply chain logistics is streamlining operations, thereby improving service delivery. As a result, the aftermarket is likely to see an increase in demand for high-tech components, which could lead to a more competitive landscape. The market is projected to grow at a compound annual growth rate (CAGR) of approximately 4.5% over the next five years, indicating a robust response to these technological changes.

Increased Vehicle Ownership

The United States Car Parts Aftermarket Market is significantly influenced by the rising trend of vehicle ownership. As more individuals acquire vehicles, the demand for replacement parts and accessories is expected to surge. Recent statistics indicate that the number of registered vehicles in the United States has surpassed 270 million, creating a substantial market for aftermarket products. This increase in vehicle ownership is particularly pronounced among younger demographics, who are more inclined to personalize their vehicles. Consequently, the aftermarket is likely to benefit from a growing consumer base that seeks to enhance vehicle performance and aesthetics. This trend suggests a promising outlook for the industry, as the need for maintenance and upgrades becomes more prevalent among a larger population of vehicle owners.

Expansion of Online Retail Channels

The United States Car Parts Aftermarket Market is increasingly benefiting from the expansion of online retail channels. E-commerce platforms are becoming the preferred shopping method for many consumers seeking car parts, driven by the convenience and accessibility they offer. Recent data indicates that online sales of automotive parts have grown significantly, with projections suggesting that e-commerce could account for over 25% of total aftermarket sales in the coming years. This shift not only allows consumers to compare prices and products easily but also enables smaller retailers to reach a broader audience. As online shopping continues to gain traction, traditional brick-and-mortar stores may need to adapt their strategies to remain competitive. The rise of online retail is likely to reshape the dynamics of the aftermarket, fostering a more diverse and competitive marketplace.

Consumer Preference for Quality Parts

The United States Car Parts Aftermarket Market is witnessing a shift in consumer preferences towards high-quality and durable parts. As vehicle owners become more informed about the importance of using reliable components, there is a growing inclination to invest in premium aftermarket products. This trend is particularly evident in the rise of specialty shops that focus on high-performance parts, catering to enthusiasts who prioritize quality over cost. Market data suggests that consumers are willing to pay a premium for parts that offer enhanced performance and longevity. This shift in consumer behavior is likely to drive innovation among manufacturers, as they strive to meet the demand for superior products. Consequently, the emphasis on quality is expected to reshape the competitive landscape of the aftermarket, fostering a culture of excellence and reliability.