Commercial Aircraft Turbine Blades Vanes Market Summary

As per Market Research Future analysis, the Commercial Aircraft Turbine Blades and Vanes Market Size was estimated at 1541.28 USD Million in 2024. The Commercial Aircraft Turbine Blades and Vanes industry is projected to grow from USD 1632.37 Million in 2025 to USD 2898.59 Million by 2035, exhibiting a compound annual growth rate (CAGR) of 5.91% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Commercial Aircraft Turbine Blades and Vanes Market is poised for growth driven by sustainability and technological advancements.

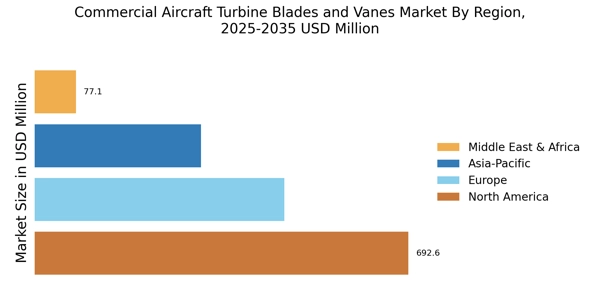

- North America remains the largest market for commercial aircraft turbine blades and vanes, reflecting robust demand and investment.

- The Asia-Pacific region is emerging as the fastest-growing market, fueled by increasing air travel and expanding airline fleets.

- Turbofan engines dominate the market, while the turbojet segment is experiencing rapid growth due to advancements in efficiency.

- Sustainability initiatives and regulatory compliance are key drivers, alongside increased investment in R&D to enhance performance and reduce environmental impact.

Market Size & Forecast

| 2024 Market Size | 1541.28 (USD Million) |

| 2035 Market Size | 2898.59 (USD Million) |

| CAGR (2025 - 2035) | 5.91% |

Major Players

General Electric (US), Rolls-Royce (GB), Pratt & Whitney (US), Safran (FR), MTU Aero Engines (DE), Honeywell (US), Boeing (US), Airbus (FR)