Growing Focus on Sustainability

The Construction Dumper Market is increasingly influenced by a growing focus on sustainability and environmental responsibility. As construction companies strive to reduce their carbon footprint, there is a rising demand for eco-friendly construction equipment, including dumpers. The adoption of electric and hybrid dumpers is becoming more prevalent, as these options offer reduced emissions and lower operating costs. Furthermore, regulatory pressures are prompting companies to invest in sustainable practices, which includes upgrading their fleets to meet environmental standards. This shift towards sustainability not only aligns with The Construction Dumper Industry. As sustainability becomes a core value in construction, the demand for environmentally friendly dumpers is expected to rise.

Expansion of the Construction Sector

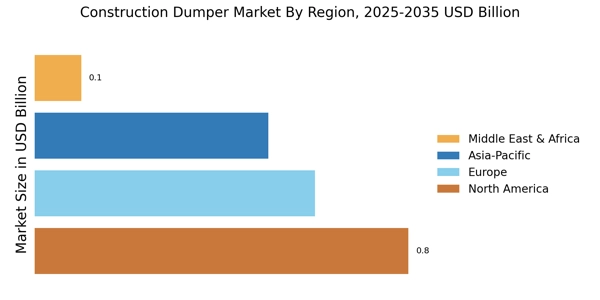

The expansion of the construction sector is a critical driver for the Construction Dumper Market. With increasing investments in residential, commercial, and industrial construction, the need for efficient material handling solutions is paramount. Recent statistics indicate that the construction sector is set to expand significantly, with particular growth in emerging markets. This expansion is likely to lead to a higher demand for construction dumpers, as they are essential for transporting heavy materials across various terrains. Additionally, the trend towards larger construction projects necessitates the use of more robust and capable dumpers. As the construction sector continues to grow, the Construction Dumper Market is expected to thrive, driven by the need for advanced equipment to support these ambitious projects.

Technological Innovations in Equipment

Technological advancements are playing a pivotal role in shaping the Construction Dumper Market. Innovations such as telematics, automation, and electric-powered dumpers are becoming increasingly prevalent. These technologies not only improve operational efficiency but also enhance safety and reduce environmental impact. For instance, the integration of telematics allows for real-time monitoring of equipment performance, which can lead to better maintenance practices and reduced downtime. Furthermore, the shift towards electric dumpers is indicative of a broader trend towards sustainability in construction. As companies seek to comply with stricter environmental regulations, the demand for technologically advanced construction dumpers is likely to increase. This trend suggests that the Construction Dumper Market will continue to evolve, driven by the need for more efficient and environmentally friendly equipment.

Government Investments in Infrastructure

Government initiatives and investments in infrastructure development are significantly influencing the Construction Dumper Market. Many countries are allocating substantial budgets for infrastructure projects, including roads, bridges, and public transportation systems. For example, recent reports indicate that infrastructure spending is expected to reach trillions of dollars over the next decade. This influx of capital is likely to stimulate demand for construction dumpers, as these vehicles are essential for transporting materials to and from construction sites. Additionally, public-private partnerships are becoming more common, further driving investment in construction projects. As governments prioritize infrastructure improvements, the Construction Dumper Market stands to gain from increased procurement of dumpers to support these large-scale initiatives.

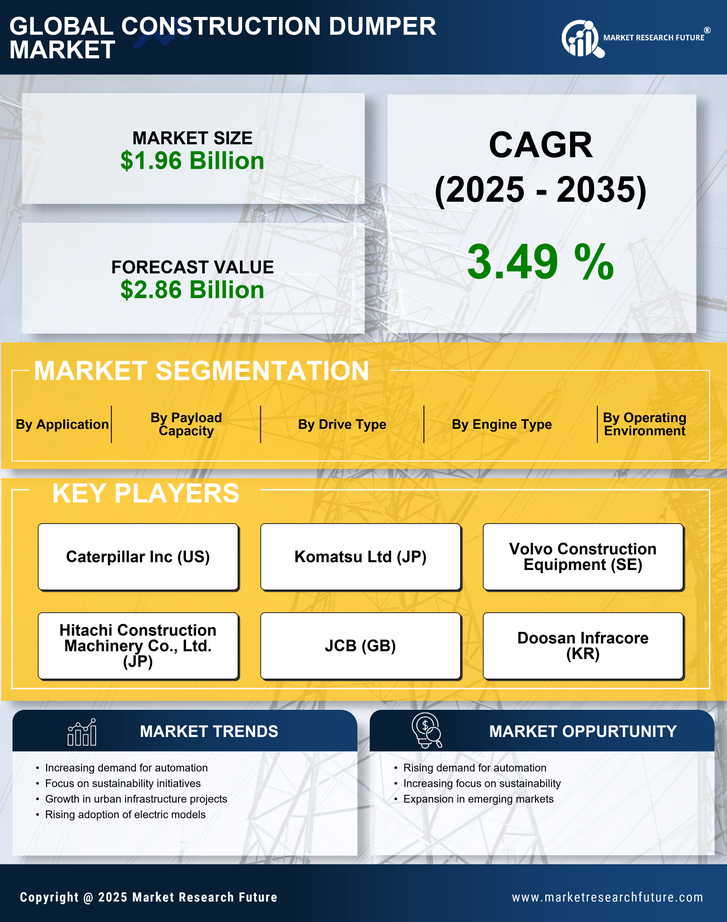

Rising Demand for Construction Activities

The Construction Dumper Market is experiencing a notable surge in demand due to increased construction activities across various sectors. This trend is driven by urbanization, population growth, and the need for infrastructure development. According to recent data, the construction sector is projected to grow at a compound annual growth rate of approximately 5.5% over the next few years. This growth is likely to result in a higher demand for construction dumpers, which are essential for transporting materials efficiently on construction sites. As construction projects become more complex and larger in scale, the reliance on advanced construction dumpers is expected to rise, thereby propelling the market forward. The Construction Dumper Market is thus positioned to benefit from this expanding demand, as stakeholders seek to enhance productivity and operational efficiency.