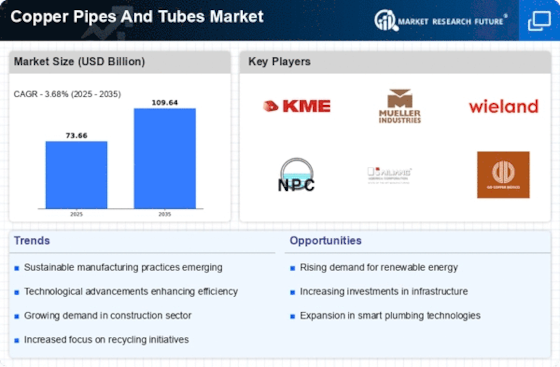

Growing HVAC Market

The Copper Pipes And Tubes Market is significantly influenced by the expansion of the heating, ventilation, and air conditioning (HVAC) market. With rising temperatures and changing climate patterns, there is an increasing need for efficient HVAC systems in residential and commercial buildings. Copper pipes and tubes are favored in HVAC applications due to their excellent thermal conductivity and reliability. The HVAC market is projected to grow at a rate of approximately 6% annually, which is likely to drive the demand for copper components. As energy efficiency becomes a priority, the use of copper in HVAC systems is expected to rise, further solidifying its position in the copper pipes and tubes market.

Rising Construction Activities

The Copper Pipes And Tubes Market is experiencing a surge in demand due to increasing construction activities across various sectors. Urbanization and infrastructure development are driving the need for reliable plumbing and heating systems, where copper pipes and tubes are preferred for their durability and efficiency. According to recent data, the construction sector is projected to grow at a compound annual growth rate of approximately 5.5% over the next few years. This growth is likely to bolster the demand for copper pipes and tubes, as they are essential components in residential, commercial, and industrial construction projects. Furthermore, the trend towards energy-efficient buildings is expected to enhance the market, as copper's thermal conductivity makes it an ideal choice for heating and cooling systems.

Regulatory Support for Copper Usage

The Copper Pipes And Tubes Market is benefiting from regulatory frameworks that promote the use of copper in various applications. Governments are increasingly recognizing the advantages of copper, such as its recyclability and antimicrobial properties, leading to policies that encourage its use in plumbing and construction. For instance, regulations aimed at reducing lead in drinking water have prompted a shift towards copper pipes, which are considered safer and more sustainable. This regulatory support is likely to enhance the market for copper pipes and tubes, as manufacturers and consumers alike seek compliant and environmentally friendly solutions. The anticipated increase in regulations favoring copper usage could further stimulate market growth in the coming years.

Increased Demand for Renewable Energy

The Copper Pipes And Tubes Market is poised to benefit from the rising demand for renewable energy solutions. As countries strive to meet sustainability goals, investments in solar and wind energy are increasing. Copper is a critical material in the manufacturing of solar panels and wind turbines, where its excellent electrical conductivity is essential for efficient energy transfer. The renewable energy sector is anticipated to grow significantly, with projections indicating a potential increase in investment by over 20% in the coming years. This trend is likely to drive the demand for copper pipes and tubes, as they are utilized in various applications, including heat exchangers and piping systems for energy generation and distribution.

Technological Innovations in Manufacturing

The Copper Pipes And Tubes Market is witnessing advancements in manufacturing technologies that enhance production efficiency and product quality. Innovations such as automated production lines and improved alloy compositions are enabling manufacturers to produce copper pipes and tubes that meet stringent industry standards. These technological advancements are not only reducing production costs but also improving the performance characteristics of copper products. For instance, the introduction of seamless copper tubes has gained traction due to their superior strength and resistance to corrosion. As manufacturers adopt these technologies, the market is likely to see an increase in the availability of high-quality copper pipes and tubes, catering to diverse applications across various industries.

.png)