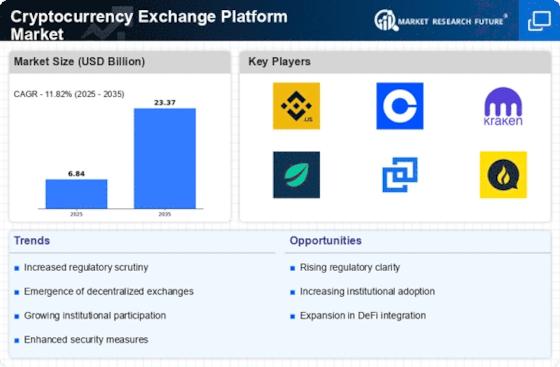

The Cryptocurrency Exchange Platform Market is currently characterized by a dynamic competitive landscape, driven by rapid technological advancements and evolving regulatory frameworks. Major players such as Binance (CN), Coinbase (US), and Kraken (US) are at the forefront, each adopting distinct strategies to enhance their market positioning. Binance (CN) continues to leverage its extensive global reach and diverse product offerings, focusing on innovation and user experience. Coinbase (US), on the other hand, emphasizes regulatory compliance and user education, aiming to attract institutional investors. Kraken (US) has carved a niche by prioritizing security and transparency, which resonates well with risk-averse customers. Collectively, these strategies contribute to a competitive environment that is increasingly focused on user trust and technological sophistication.

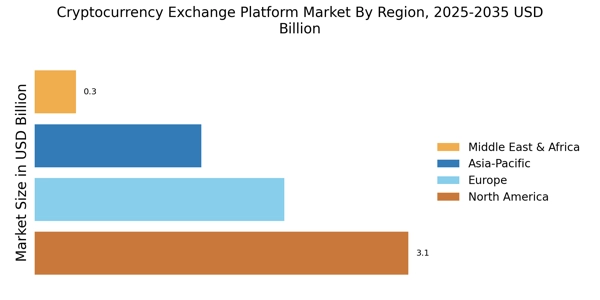

In terms of business tactics, companies are increasingly localizing their operations to better serve regional markets, optimizing their supply chains to enhance efficiency. The market structure appears moderately fragmented, with a mix of established players and emerging startups vying for market share. This fragmentation allows for a variety of service offerings, catering to different customer segments, while the collective influence of key players shapes market trends and consumer expectations.

In September 2025, Binance (CN) announced the launch of its new decentralized finance (DeFi) platform, aiming to capitalize on the growing interest in DeFi solutions. This strategic move not only diversifies Binance's offerings but also positions it as a leader in the DeFi space, potentially attracting a new customer base interested in decentralized trading options. The launch underscores Binance's commitment to innovation and its ability to adapt to market demands.

In August 2025, Coinbase (US) expanded its operations into several emerging markets, including Southeast Asia and Africa, by establishing local partnerships. This expansion strategy is significant as it allows Coinbase to tap into underbanked populations, thereby increasing its user base and enhancing financial inclusion. By localizing its services, Coinbase aims to build trust and foster community engagement, which could lead to long-term customer loyalty.

In July 2025, Kraken (US) introduced a new suite of security features, including advanced biometric authentication and enhanced encryption protocols. This initiative is particularly relevant in an era where cybersecurity threats are prevalent. By prioritizing security, Kraken not only protects its users but also differentiates itself in a crowded market, appealing to customers who prioritize safety in their trading activities.

As of October 2025, the competitive trends in the Cryptocurrency Exchange Platform Market are increasingly defined by digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances are becoming more common, as companies seek to enhance their technological capabilities and expand their service offerings. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on innovation, technology, and supply chain reliability. This shift suggests that companies that can effectively leverage technology and build strategic partnerships will be better positioned to thrive in the future.

Leave a Comment