Regulatory Developments and Compliance

The Cryptocurrency Mining Hardware Market is significantly influenced by regulatory developments across various jurisdictions. Governments are increasingly establishing frameworks to govern cryptocurrency mining activities, which can impact hardware demand. For instance, regulations aimed at reducing energy consumption and promoting sustainable practices may compel miners to upgrade their equipment to comply with new standards. In 2025, it is anticipated that stricter regulations will emerge, particularly in regions where mining has been criticized for its environmental impact. This regulatory landscape may create opportunities for manufacturers to develop compliant hardware solutions that meet the evolving requirements. Consequently, the Cryptocurrency Mining Hardware Market must remain agile to adapt to these changes, ensuring that miners can operate within legal parameters while optimizing their hardware investments.

Increased Demand for Cryptocurrency Mining

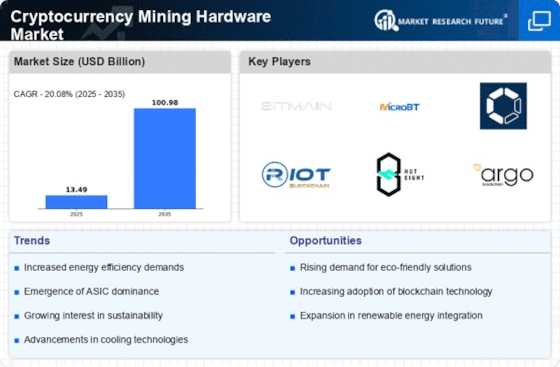

The Cryptocurrency Mining Hardware Market is experiencing a surge in demand as more individuals and institutions engage in cryptocurrency mining. This trend is driven by the rising popularity of cryptocurrencies, which has led to an increase in the number of miners seeking efficient hardware solutions. In 2025, the market is projected to grow at a compound annual growth rate of approximately 10%, indicating a robust interest in mining activities. As more miners enter the space, the need for advanced mining hardware becomes critical, pushing manufacturers to innovate and enhance their offerings. This demand is not only limited to individual miners but also extends to large-scale mining operations, which require high-performance equipment to remain competitive. Consequently, the Cryptocurrency Mining Hardware Market is poised for significant growth as it adapts to the evolving landscape of digital currencies.

Rising Energy Costs and Efficiency Concerns

Energy costs are a critical factor influencing the Cryptocurrency Mining Hardware Market. As electricity prices continue to rise, miners are increasingly focused on acquiring energy-efficient hardware to maintain profitability. In 2025, the emphasis on energy consumption is expected to intensify, prompting miners to seek out equipment that offers superior performance without exorbitant energy costs. This trend is likely to drive innovation in the design and manufacturing of mining hardware, as companies strive to create solutions that balance power and efficiency. Furthermore, the growing awareness of environmental sustainability may lead miners to prioritize hardware that minimizes their carbon footprint. Consequently, the Cryptocurrency Mining Hardware Market is adapting to these challenges by promoting energy-efficient technologies that align with the financial and environmental goals of miners.

Technological Innovations in Mining Equipment

Technological advancements play a pivotal role in shaping the Cryptocurrency Mining Hardware Market. Innovations such as application-specific integrated circuits (ASICs) and field-programmable gate arrays (FPGAs) have revolutionized mining efficiency and power consumption. These technologies enable miners to achieve higher hash rates while minimizing energy usage, which is crucial given the rising electricity costs associated with mining operations. In 2025, the introduction of next-generation mining rigs is expected to further enhance performance, allowing miners to maximize their returns. Additionally, advancements in cooling technologies and energy-efficient designs are likely to attract environmentally conscious miners. As a result, the Cryptocurrency Mining Hardware Market is witnessing a continuous influx of cutting-edge products that cater to the needs of both novice and experienced miners.

Growing Interest in Decentralized Finance (DeFi)

The rise of decentralized finance (DeFi) is reshaping the Cryptocurrency Mining Hardware Market. As DeFi platforms gain traction, the demand for mining hardware that supports various blockchain networks is increasing. Miners are now looking for versatile equipment capable of mining multiple cryptocurrencies, which enhances their profitability and reduces risk. In 2025, the DeFi sector is expected to continue its expansion, further driving the need for adaptable mining solutions. This trend encourages hardware manufacturers to innovate and produce equipment that can efficiently mine a range of digital assets. As a result, the Cryptocurrency Mining Hardware Market is likely to see a diversification of product offerings, catering to the evolving needs of miners engaged in DeFi activities.

Leave a Comment