Institutional Investment Growth

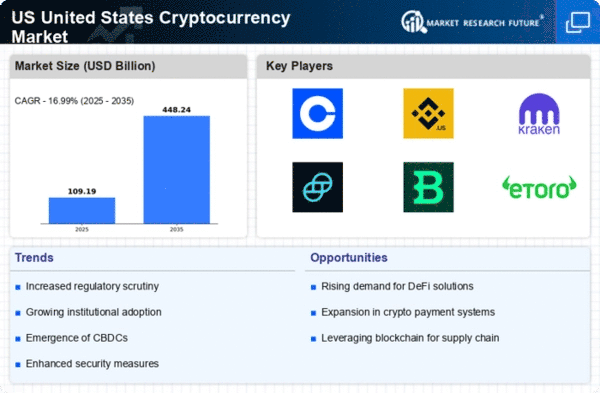

The United States Cryptocurrency Market is witnessing a notable increase in institutional investment. Major financial institutions and hedge funds are increasingly allocating capital to cryptocurrencies, driven by the search for diversification and potential high returns. In 2025, institutional investments in cryptocurrencies are projected to exceed 20 billion USD, reflecting a growing acceptance of digital assets as a legitimate asset class. This influx of capital not only enhances market liquidity but also contributes to price stability, fostering a more robust market environment. Furthermore, the participation of institutional investors may lead to the development of more sophisticated financial products, such as cryptocurrency ETFs, which could further attract retail investors. As institutions continue to embrace cryptocurrencies, the overall credibility and legitimacy of the United States Cryptocurrency Market are likely to strengthen.

Regulatory Clarity and Compliance

Regulatory clarity is emerging as a pivotal driver for the United States Cryptocurrency Market. In recent years, regulatory bodies have made strides in establishing frameworks that govern cryptocurrency transactions and exchanges. This clarity is essential for fostering trust among investors and consumers alike. As of October 2025, the implementation of comprehensive regulations is expected to enhance compliance among market participants, thereby reducing the risks associated with fraud and market manipulation. The establishment of clear guidelines may also encourage more businesses to adopt cryptocurrencies as a payment method, further integrating digital assets into the mainstream economy. Consequently, the regulatory landscape is likely to play a crucial role in shaping the future trajectory of the United States Cryptocurrency Market, potentially leading to increased participation from both retail and institutional investors.

Technological Innovations in Blockchain

Technological innovations in blockchain are significantly influencing the United States Cryptocurrency Market. Advancements in blockchain technology, such as scalability solutions and interoperability protocols, are enhancing the efficiency and functionality of cryptocurrency networks. In 2025, the market is expected to see a surge in decentralized finance (DeFi) applications, which leverage blockchain technology to offer financial services without intermediaries. This trend is likely to attract a broader audience, as users seek alternatives to traditional banking systems. Moreover, the integration of artificial intelligence and machine learning into blockchain systems may improve security and transaction speeds, further bolstering user confidence. As these technological advancements continue to unfold, they are poised to reshape the landscape of the United States Cryptocurrency Market, potentially leading to increased adoption and innovation.

Rising Consumer Demand for Digital Assets

Rising consumer demand for digital assets is a key driver of the United States Cryptocurrency Market. As more individuals become aware of cryptocurrencies and their potential benefits, the number of retail investors is steadily increasing. In 2025, it is estimated that over 30 million Americans will own some form of cryptocurrency, reflecting a growing trend towards digital asset ownership. This surge in consumer interest is fueled by the desire for alternative investment opportunities and the potential for high returns. Additionally, the increasing acceptance of cryptocurrencies by major retailers and service providers is further driving consumer adoption. As the market matures, the United States Cryptocurrency Market is likely to experience a shift in consumer behavior, with more individuals seeking to integrate digital assets into their everyday financial activities.

Global Economic Factors and Inflation Hedge

The United States Cryptocurrency Industry. In an environment characterized by rising inflation and economic uncertainty, cryptocurrencies are increasingly viewed as a hedge against traditional financial market volatility. As of October 2025, many investors are turning to digital assets to preserve their wealth and mitigate risks associated with fiat currencies. This trend is particularly pronounced among younger investors, who are more inclined to embrace cryptocurrencies as a viable alternative to conventional investments. The perception of cryptocurrencies as a store of value is likely to drive further interest and investment in the United States Cryptocurrency Market. Consequently, the interplay between economic conditions and investor sentiment may significantly influence the market's growth trajectory in the coming years.

Leave a Comment