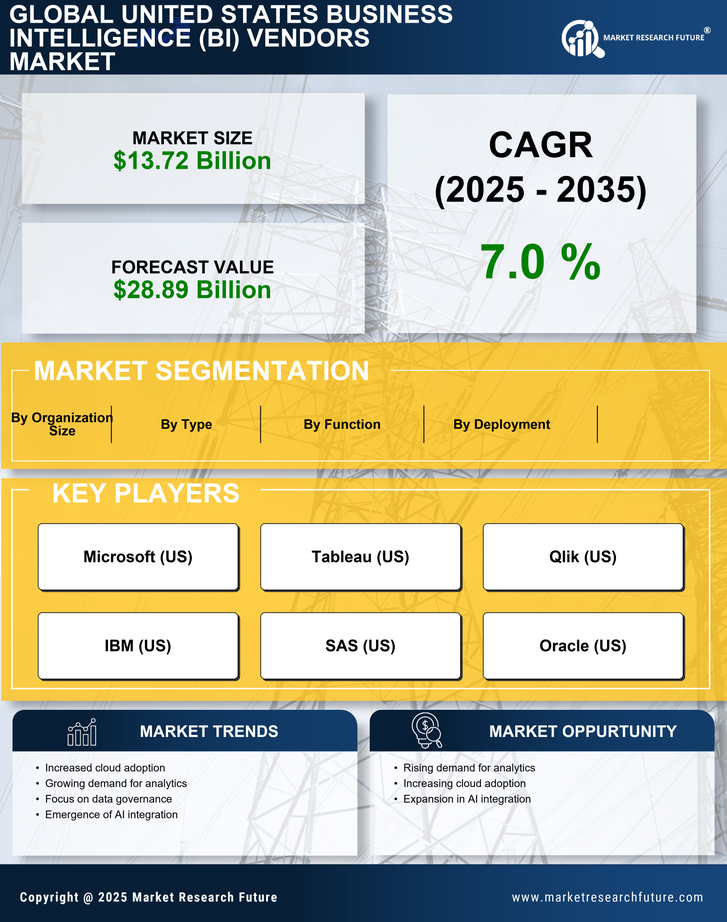

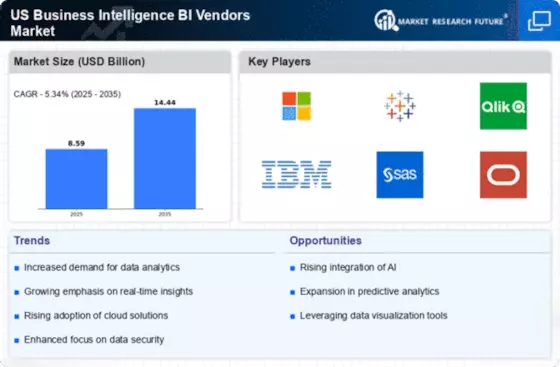

The Business Intelligence (BI) Vendors Market in the US is characterized by a dynamic competitive landscape, driven by rapid technological advancements and an increasing demand for data-driven decision-making. Key players such as Microsoft (US), Tableau (US), and IBM (US) are strategically positioned to leverage their extensive resources and innovative capabilities. Microsoft (US) focuses on integrating AI and

machine learning into its BI solutions, enhancing user experience and analytical capabilities. Tableau (US), known for its user-friendly interface, emphasizes partnerships with cloud service providers to expand its market reach. Meanwhile, IBM (US) is concentrating on

hybrid cloud solutions, which allows for greater flexibility and scalability in data management. Collectively, these strategies contribute to a competitive environment that is increasingly centered around innovation and customer-centric solutions.

In terms of business tactics, companies are increasingly localizing their operations and optimizing supply chains to enhance efficiency and responsiveness. The market structure appears moderately fragmented, with several players vying for market share, yet dominated by a few key firms that hold substantial influence. This competitive structure fosters an environment where innovation and strategic partnerships are essential for maintaining a competitive edge.

In December 2025, Microsoft (US) announced the launch of its new AI-driven analytics platform, which aims to streamline data processing and provide real-time insights for businesses. This strategic move is significant as it positions Microsoft (US) at the forefront of the AI integration trend within the BI sector, potentially attracting a broader customer base seeking advanced analytical capabilities. The emphasis on AI not only enhances the functionality of their offerings but also aligns with the growing market demand for intelligent data solutions.

In November 2025, Tableau (US) expanded its partnership with Amazon Web Services (US) to enhance its cloud-based analytics capabilities. This collaboration is crucial as it allows Tableau (US) to leverage AWS's robust infrastructure, thereby improving performance and scalability for its users. The partnership underscores the importance of cloud solutions in the BI market, as organizations increasingly migrate to cloud environments for their

data analytics needs.

In October 2025, IBM (US) unveiled its new

hybrid cloud data platform, designed to facilitate seamless data integration across various environments. This strategic initiative is vital as it addresses the growing need for businesses to manage data across on-premises and cloud systems efficiently. By focusing on hybrid solutions, IBM (US) positions itself as a leader in providing flexible and scalable data management options, catering to the diverse needs of modern enterprises.

As of January 2026, the competitive trends in the BI market are heavily influenced by digitalization, sustainability, and the integration of

AI technologies. Strategic alliances are increasingly shaping the landscape, enabling companies to enhance their offerings and expand their market presence. Looking ahead, it is likely that competitive differentiation will evolve, shifting from price-based competition to a focus on innovation, technological advancements, and supply chain reliability. This transition suggests that companies that prioritize these aspects will be better positioned to thrive in the evolving BI market.