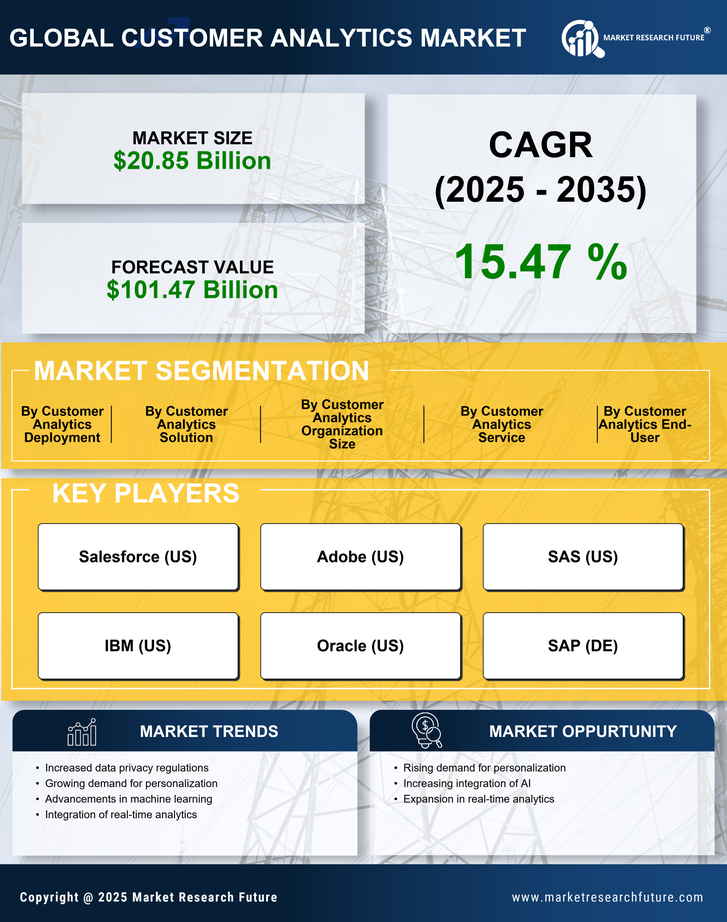

The Customer Analytics Market is currently characterized by a dynamic competitive landscape, driven by the increasing demand for data-driven decision-making and personalized customer experiences. Leading customer analytics companies such as Salesforce, Adobe, and IBM continue to strengthen their customer market share through innovation and AI-driven platforms. Major players such as Salesforce (US), Adobe (US), and IBM (US) are at the forefront, each adopting distinct strategies to enhance their market positioning. Salesforce (US) emphasizes innovation through its robust cloud-based solutions, while Adobe (US) focuses on integrating advanced analytics with creative tools to provide comprehensive customer insights. IBM (US), on the other hand, leverages its strong AI capabilities to offer predictive analytics, thereby enhancing customer engagement strategies. Collectively, these strategies contribute to a competitive environment that is increasingly focused on technological advancement and customer-centric solutions.

In terms of business tactics, companies are increasingly localizing their operations and optimizing supply chains to better serve diverse markets. The Customer Analytics Market appears moderately fragmented, with a mix of established players and emerging startups. The influence of key players is substantial, as they not only set industry standards but also drive innovation through strategic partnerships and acquisitions, thereby shaping the overall market structure.

In August 2025, Salesforce (US) announced a strategic partnership with a leading AI firm to enhance its analytics capabilities. This collaboration aims to integrate advanced machine learning algorithms into Salesforce's existing platforms, allowing for more nuanced customer insights and predictive analytics. The significance of this move lies in its potential to solidify Salesforce's position as a leader in the market, enabling it to offer more sophisticated tools that cater to evolving customer needs.

Similarly, in September 2025, Adobe (US) launched a new suite of analytics tools designed specifically for e-commerce businesses. This initiative reflects Adobe's commitment to providing tailored solutions that address the unique challenges faced by online retailers. By focusing on this niche, Adobe not only expands its market reach but also enhances its competitive edge in a rapidly growing segment of the Customer Analytics Market.

Moreover, in July 2025, IBM (US) unveiled a new AI-driven analytics platform aimed at small to medium-sized enterprises (SMEs). This platform is designed to democratize access to advanced analytics, allowing smaller businesses to leverage data insights that were previously available only to larger corporations. The strategic importance of this launch lies in IBM's ability to tap into a new customer base, thereby fostering growth in an underserved segment of the market.

As of October 2025, the Customer Analytics Market is witnessing trends such as digitalization, sustainability, and the integration of AI technologies. Strategic alliances are increasingly shaping the competitive landscape, as companies recognize the value of collaboration in driving innovation. Looking ahead, it is likely that competitive differentiation will evolve, with a shift from traditional price-based competition to a focus on innovation, technological advancement, and

supply chain reliability. This transition underscores the importance of agility and responsiveness in meeting the demands of a rapidly changing market.