Growing Geriatric Population

The rise in the geriatric population globally contributes to the expansion of the Global Dental Adhesives and Sealants Market Industry. Older adults often experience dental issues such as decay and tooth loss, necessitating the use of adhesives and sealants for restorative procedures. As the global population aged 65 and older continues to increase, dental professionals are likely to rely more on these products to ensure effective treatment outcomes. This demographic shift not only drives demand but also encourages innovation in adhesive technologies tailored for elderly patients, thereby enhancing the overall market landscape.

Increasing Dental Expenditure

Rising dental expenditure among consumers is a key driver of the Global Dental Adhesives and Sealants Market Industry. As individuals allocate more resources to oral health, the demand for high-quality dental products, including adhesives and sealants, increases. This trend is particularly pronounced in developed regions where access to dental care is more prevalent. Additionally, insurance coverage for preventive and restorative dental procedures encourages consumers to seek treatments that utilize these products. Consequently, the market is poised for growth as consumers prioritize their dental health, leading to a more robust demand for adhesives and sealants.

Rising Demand for Preventive Dental Care

The increasing awareness of preventive dental care among consumers drives the Global Dental Adhesives and Sealants Market Industry. As individuals become more informed about oral health, the demand for products that prevent dental issues rises. This trend is particularly evident in pediatric dentistry, where sealants are applied to children's teeth to prevent cavities. The market is projected to reach 8.16 USD Billion in 2024, reflecting a growing emphasis on preventive measures. Furthermore, educational initiatives by dental associations contribute to this awareness, encouraging regular dental visits and the use of adhesives and sealants for long-term oral health.

Regulatory Support for Dental Innovations

Regulatory bodies play a crucial role in shaping the Global Dental Adhesives and Sealants Market Industry by establishing guidelines that promote the safety and efficacy of dental products. Supportive regulations facilitate the introduction of innovative adhesives and sealants, ensuring they meet stringent safety standards. This regulatory environment encourages manufacturers to invest in research and development, leading to the creation of high-quality products that meet consumer needs. As a result, the market is likely to benefit from increased product offerings and enhanced consumer trust, further driving growth in the sector.

Technological Advancements in Dental Materials

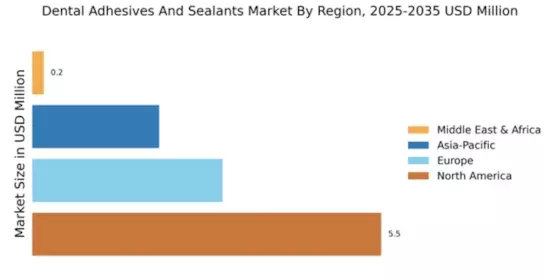

Technological innovations in dental materials significantly impact the Global Dental Adhesives and Sealants Market Industry. The development of advanced adhesive formulations and sealants enhances bonding strength and durability, resulting in improved clinical outcomes. For instance, the introduction of light-cured adhesives allows for quicker application and setting times, which is particularly beneficial in busy dental practices. These advancements not only improve patient satisfaction but also increase the efficiency of dental procedures. As a result, the market is expected to grow at a CAGR of 7.21% from 2025 to 2035, reaching an estimated 17.6 USD Billion by 2035.