Rising Demand for Biopharmaceuticals

The Difficult to Express Protein Market is experiencing a notable surge in demand for biopharmaceuticals, which are increasingly reliant on complex proteins. As the healthcare sector evolves, the need for innovative therapies, including monoclonal antibodies and therapeutic proteins, has escalated. According to recent data, the biopharmaceutical market is projected to reach approximately 500 billion USD by 2026, indicating a robust growth trajectory. This demand drives the need for advanced expression systems capable of producing these challenging proteins efficiently. Consequently, companies within the Difficult to Express Protein Market are investing in research and development to enhance production capabilities, thereby addressing the growing needs of the biopharmaceutical sector.

Increased Investment in Biotechnology

Investment trends indicate a growing interest in the biotechnology sector, which directly influences the Difficult to Express Protein Market. Venture capital funding for biotech firms has seen a significant uptick, with investments reaching over 20 billion USD in the past year alone. This influx of capital is primarily directed towards companies specializing in the development of complex proteins, as they are crucial for the advancement of personalized medicine and targeted therapies. The heightened investment not only accelerates research and development efforts but also fosters collaborations between academic institutions and industry players. Such dynamics are likely to enhance the capabilities of the Difficult to Express Protein Market, enabling it to meet the increasing demands of the healthcare sector.

Growing Focus on Personalized Medicine

The shift towards personalized medicine is reshaping the landscape of the Difficult to Express Protein Market. As healthcare providers increasingly adopt tailored treatment approaches, the demand for specific proteins that can address individual patient needs is on the rise. This trend necessitates the development of proteins that are often difficult to express, as they require precise modifications to achieve desired therapeutic effects. Market analysts project that the personalized medicine market will exceed 2 trillion USD by 2030, underscoring the potential for growth within the Difficult to Express Protein Market. Companies are thus compelled to innovate and refine their production processes to cater to this burgeoning demand, ensuring that they can provide the necessary proteins for personalized therapies.

Advancements in Expression Technologies

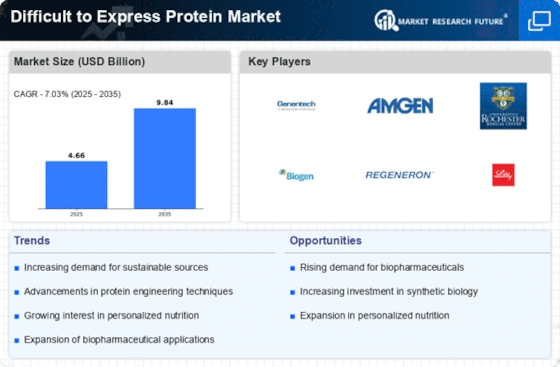

Technological innovations play a pivotal role in shaping the Difficult to Express Protein Market. Recent advancements in expression technologies, such as the development of novel host systems and improved vector designs, have significantly enhanced the yield and quality of difficult-to-express proteins. For instance, the introduction of mammalian cell systems has shown promise in producing complex glycoproteins, which are essential for various therapeutic applications. The market for expression systems is expected to grow at a compound annual growth rate of around 10% over the next five years, reflecting the increasing reliance on these technologies. As a result, companies are likely to focus on integrating these advancements into their production processes to remain competitive in the Difficult to Express Protein Market.

Regulatory Support for Biotech Innovations

Regulatory frameworks are evolving to support innovations within the Difficult to Express Protein Market. Governments and regulatory bodies are increasingly recognizing the importance of biopharmaceuticals and are streamlining approval processes for new therapies. This supportive environment encourages companies to invest in the development of difficult-to-express proteins, as they can navigate regulatory hurdles more efficiently. Recent initiatives have been introduced to expedite the review of biologics, which is likely to enhance the speed at which new therapies reach the market. As a result, the Difficult to Express Protein Market stands to benefit from these regulatory advancements, fostering an atmosphere conducive to innovation and growth.