E-commerce Growth

The rapid expansion of e-commerce has emerged as a pivotal driver for The Global Express Delivery Industry. As online shopping continues to gain traction, the demand for swift and reliable delivery services has surged. In 2025, e-commerce sales are projected to reach approximately 6 trillion USD, indicating a robust growth trajectory. This trend compels express delivery companies to enhance their logistics capabilities, ensuring timely deliveries to meet consumer expectations. The increasing preference for same-day and next-day delivery options further underscores the necessity for efficient express delivery solutions. Consequently, businesses are investing in advanced technologies and infrastructure to streamline operations, thereby positioning themselves favorably within the competitive landscape of The Global Express Delivery Industry.

Urbanization Trends

Urbanization trends significantly influence the dynamics of The Global Express Delivery Industry. As populations migrate towards urban centers, the demand for express delivery services intensifies. In 2025, it is estimated that over 55% of the world's population will reside in urban areas, creating a pressing need for efficient logistics solutions. Urban environments present unique challenges, including traffic congestion and limited access to certain locations, which necessitate innovative delivery strategies. Companies are increasingly exploring options such as drone deliveries and electric vehicles to navigate these challenges effectively. This shift not only enhances delivery speed but also aligns with sustainability goals, making it a compelling driver for growth within The Global Express Delivery Industry.

Consumer Expectations

Consumer expectations are evolving rapidly, serving as a significant driver for The Global Express Delivery Industry. Today's consumers demand not only speed but also transparency and reliability in their delivery experiences. The rise of tracking technologies has empowered customers to monitor their shipments in real-time, fostering a sense of control and satisfaction. In 2025, surveys indicate that over 70% of consumers prioritize fast delivery options, with many willing to pay a premium for expedited services. This shift in consumer behavior compels express delivery companies to adapt their offerings, ensuring they meet these heightened expectations. As a result, businesses are investing in customer service enhancements and innovative delivery solutions to maintain competitiveness in The Global Express Delivery Industry.

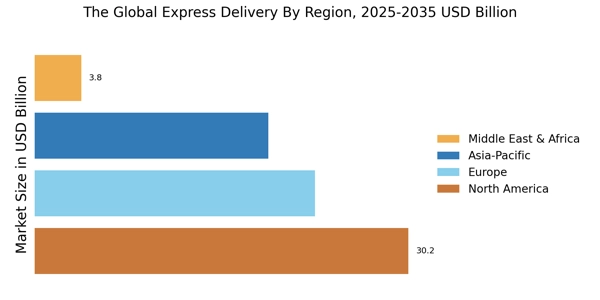

Global Trade Expansion

The expansion of The Global Express Delivery Industry. As international commerce continues to flourish, the need for efficient cross-border logistics becomes increasingly critical. In 2025, global trade is projected to exceed 30 trillion USD, highlighting the growing interconnectedness of markets. This trend necessitates the development of robust express delivery networks capable of handling international shipments swiftly and reliably. Companies are focusing on streamlining customs processes and enhancing collaboration with international partners to facilitate smoother transactions. Furthermore, the rise of free trade agreements and reduced trade barriers are likely to bolster the demand for express delivery services, positioning them as essential components of the global supply chain.

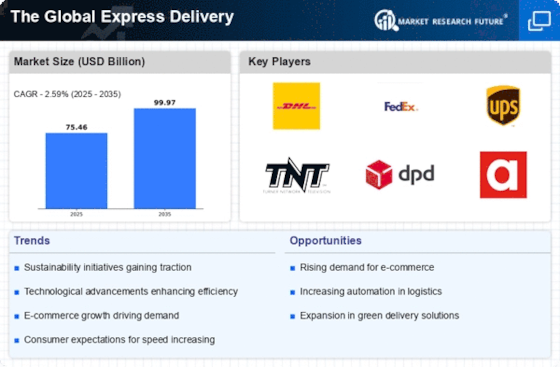

Technological Advancements

Technological advancements play a crucial role in shaping The Global Express Delivery Industry. Innovations such as artificial intelligence, machine learning, and automation are revolutionizing logistics and supply chain management. These technologies enable companies to optimize routes, reduce delivery times, and enhance overall efficiency. For instance, the integration of AI-driven analytics allows for better demand forecasting, which is essential for managing inventory and resources effectively. Moreover, the adoption of automated sorting and delivery systems is becoming increasingly prevalent, facilitating faster processing of shipments. As a result, express delivery services can offer improved reliability and customer satisfaction, which are vital in a market characterized by heightened competition and evolving consumer preferences.