Dirt Bike Market Summary

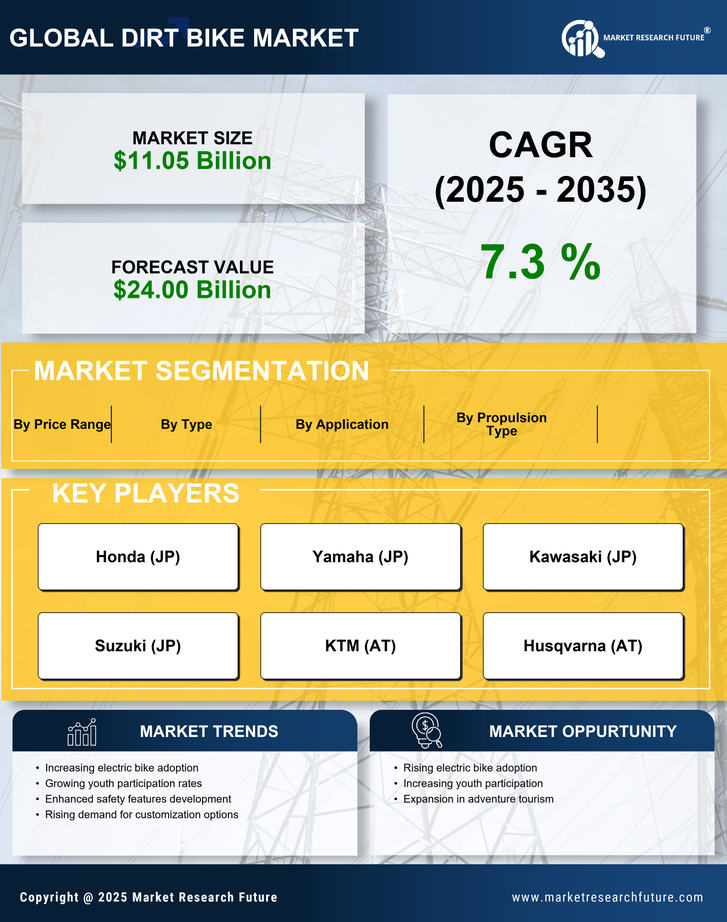

As per Market Research Future analysis, the Dirt Bike Market Size was estimated at 11.05 USD Billion in 2024. The Dirt Bike industry is projected to grow from 11.86 USD Billion in 2025 to 24.0 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 7% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Dirt Bike Market is experiencing a transformative shift towards electric models and customization, driven by youth engagement and sustainability.

- The market is witnessing a notable rise in electric models, reflecting a growing consumer preference for sustainable options.

- Customization is becoming increasingly popular among riders, allowing for personalized experiences and enhanced performance.

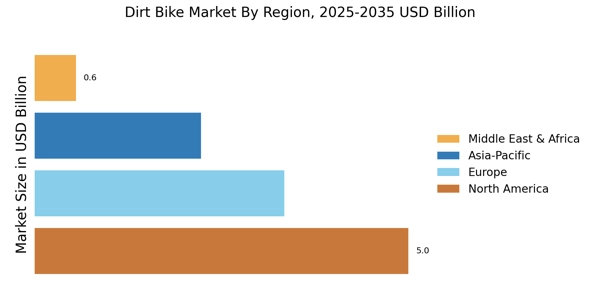

- North America remains the largest market, while the Asia-Pacific region is emerging as the fastest-growing area for dirt bikes.

- The increasing popularity of off-road activities and technological advancements in dirt bikes are key drivers propelling market growth.

Market Size & Forecast

| 2024 Market Size | 11.05 (USD Billion) |

| 2035 Market Size | 24.0 (USD Billion) |

| CAGR (2025 - 2035) | 7.3% |

Major Players

Honda (JP), Yamaha (JP), Kawasaki (JP), Suzuki (JP), KTM (AT), Husqvarna (AT), Beta (IT), GasGas (ES), Polaris (US), CFMOTO (CN)