Expansion of 5G Networks

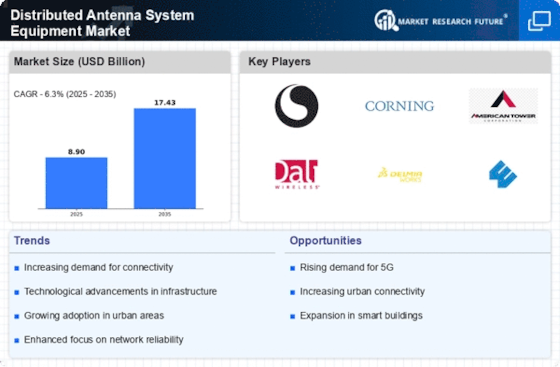

The rollout of 5G networks is a pivotal factor influencing the Distributed Antenna System Equipment Market. As telecommunications companies expand their 5G infrastructure, the demand for distributed antenna systems is likely to rise significantly. 5G technology promises faster data speeds, lower latency, and improved connectivity, which necessitates the installation of advanced DAS solutions to support these capabilities. The market for 5G infrastructure is expected to reach several billion dollars by the end of the decade, indicating a substantial opportunity for DAS providers. This expansion not only enhances user experience but also drives the need for more sophisticated distributed antenna systems to ensure optimal performance in urban and rural settings alike.

Rising Mobile Data Traffic

The Distributed Antenna System Equipment Market is experiencing a surge in demand due to the exponential increase in mobile data traffic. As more users rely on smartphones and mobile devices for various applications, the need for robust and reliable connectivity becomes paramount. According to recent statistics, mobile data traffic is projected to grow at a compound annual growth rate of over 25% in the coming years. This growth necessitates the deployment of distributed antenna systems to enhance coverage and capacity in densely populated areas. Consequently, service providers are investing heavily in DAS technology to meet user expectations and ensure seamless connectivity. The rising mobile data traffic is thus a critical driver for the Distributed Antenna System Equipment Market, pushing for innovative solutions that can handle the increasing load.

Integration with IoT Devices

The integration of distributed antenna systems with Internet of Things (IoT) devices is emerging as a significant driver for the Distributed Antenna System Equipment Market. As IoT applications proliferate across various sectors, the demand for reliable and high-capacity connectivity becomes increasingly critical. Distributed antenna systems play a vital role in supporting the connectivity needs of IoT devices, ensuring seamless communication and data transfer. The IoT market is expected to grow exponentially, with billions of connected devices anticipated in the near future. This growth presents a substantial opportunity for DAS providers to develop solutions that cater to the unique requirements of IoT applications, thereby driving the Distributed Antenna System Equipment Market forward.

Government Initiatives and Funding

Government initiatives and funding aimed at improving telecommunications infrastructure are significantly impacting the Distributed Antenna System Equipment Market. Many governments are recognizing the importance of robust connectivity for economic growth and social development. As a result, they are investing in projects that enhance mobile network coverage and capacity, particularly in underserved areas. These initiatives often include financial incentives for telecommunications companies to deploy distributed antenna systems. The allocation of public funds for infrastructure development is likely to create a favorable environment for the growth of the DAS market. Consequently, government support is a crucial driver for the Distributed Antenna System Equipment Market, facilitating advancements in technology and expanding market opportunities.

Increased Focus on Indoor Coverage Solutions

The Distributed Antenna System Equipment Market is witnessing a heightened emphasis on indoor coverage solutions. As organizations and businesses recognize the importance of reliable connectivity within their premises, the demand for DAS technology is on the rise. Many enterprises are investing in distributed antenna systems to improve signal strength and quality in buildings, shopping malls, and other indoor environments. This trend is further supported by the fact that a significant portion of mobile data usage occurs indoors. The market for indoor DAS solutions is projected to grow substantially, driven by the need for enhanced user experiences and operational efficiency. Consequently, the focus on indoor coverage solutions is a key driver for the Distributed Antenna System Equipment Market.