DNA Sequencing Market Summary

As per Market Research Future analysis, the DNA Sequencing Market Size was estimated at 15.63 USD Billion in 2024. The DNA Sequencing industry is projected to grow from 17.66 USD Billion in 2025 to 59.79 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 12.9% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The DNA Sequencing Market is poised for substantial growth driven by technological advancements and increasing demand for personalized medicine.

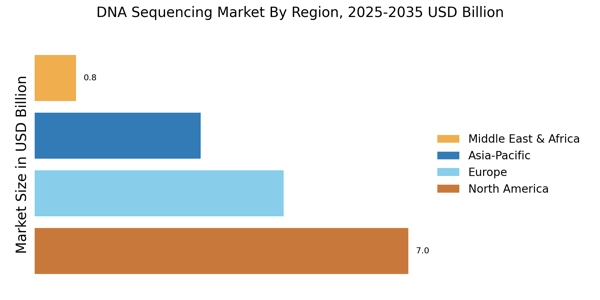

- North America remains the largest market for DNA sequencing, driven by robust research and development activities.

- The Asia-Pacific region is emerging as the fastest-growing market, fueled by increasing investments in biotechnology and healthcare.

- Consumables dominate the market, while instruments are experiencing the fastest growth due to ongoing technological innovations.

- Key market drivers include technological advancements in DNA sequencing and a growing demand for personalized medicine, particularly in clinical diagnostics.

Market Size & Forecast

| 2024 Market Size | 15.63 (USD Billion) |

| 2035 Market Size | 59.79 (USD Billion) |

| CAGR (2025 - 2035) | 12.97% |

Major Players

Illumina (US), Thermo Fisher Scientific (US), Pacific Biosciences (US), Oxford Nanopore Technologies (GB), BGI Genomics (CN), Roche (CH), Agilent Technologies (US), Qiagen (DE), Genomatix (DE)