Cost Efficiency in Oil Transportation

Cost efficiency remains a critical driver in the DRA for Oil Pipeline Transportation Market. The implementation of drag reducing agents can lead to substantial savings in transportation costs by minimizing friction losses within pipelines. This reduction in friction allows for higher flow rates, which can decrease the overall energy required for pumping oil. Industry reports suggest that using DRA can enhance flow efficiency by up to 30%, translating into significant cost reductions for operators. As oil prices fluctuate, the need for cost-effective solutions becomes increasingly vital, making DRA an attractive option for pipeline operators seeking to maintain profitability in a competitive market.

Growing Investment in Pipeline Projects

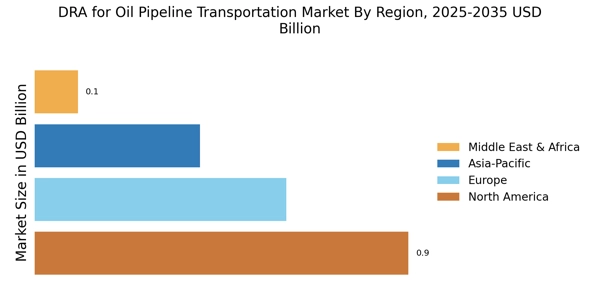

Investment in pipeline infrastructure is a significant driver for the DRA for Oil Pipeline Transportation Market. As countries seek to enhance their energy security and meet growing demand, there is a marked increase in the development of new pipeline projects. This trend is particularly evident in regions rich in oil reserves, where the need for efficient transportation solutions is paramount. The influx of capital into pipeline construction and upgrades creates opportunities for the adoption of drag reducing agents, as operators look to maximize the efficiency of their new systems. Consequently, the DRA market is poised for growth as these investments materialize.

Increasing Demand for Oil Transportation

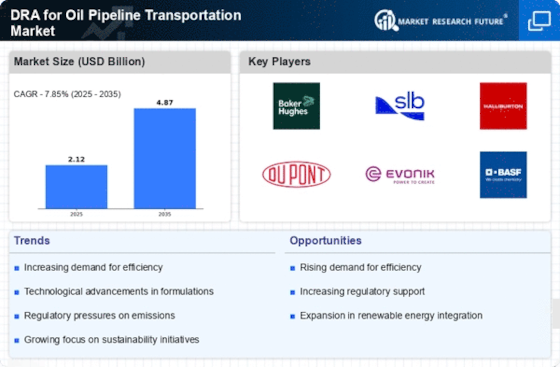

The DRA for Oil Pipeline Transportation Market is experiencing a surge in demand due to the rising global energy needs. As economies expand, the requirement for efficient oil transportation becomes paramount. Enhanced oil recovery techniques and the need for transporting crude oil over long distances necessitate the use of drag reducing agents (DRA). According to recent estimates, the oil transportation sector is projected to grow at a compound annual growth rate (CAGR) of approximately 4.5% over the next five years. This growth is likely to drive the adoption of DRA, as it improves flow rates and reduces energy consumption, thereby optimizing operational efficiency in the oil pipeline sector.

Environmental Regulations and Sustainability Goals

The DRA for Oil Pipeline Transportation Market is influenced by stringent environmental regulations aimed at reducing carbon emissions and promoting sustainability. Governments and regulatory bodies are increasingly mandating the adoption of practices that minimize environmental impact. The use of drag reducing agents aligns with these sustainability goals by enhancing the efficiency of oil transport, thereby reducing the carbon footprint associated with pumping operations. As companies strive to comply with these regulations, the demand for DRA is expected to rise, as it offers a viable solution for achieving both operational efficiency and environmental compliance.

Technological Innovations in Pipeline Infrastructure

Technological advancements play a pivotal role in shaping the DRA for Oil Pipeline Transportation Market. Innovations in pipeline materials and monitoring systems have enhanced the efficiency and safety of oil transportation. The integration of smart technologies, such as real-time monitoring and predictive maintenance, allows for better management of pipeline operations. These advancements not only improve the reliability of oil transport but also create an environment conducive to the use of drag reducing agents. As operators seek to optimize their infrastructure, the adoption of DRA is likely to increase, driven by the need for enhanced performance and reduced operational risks.

Leave a Comment