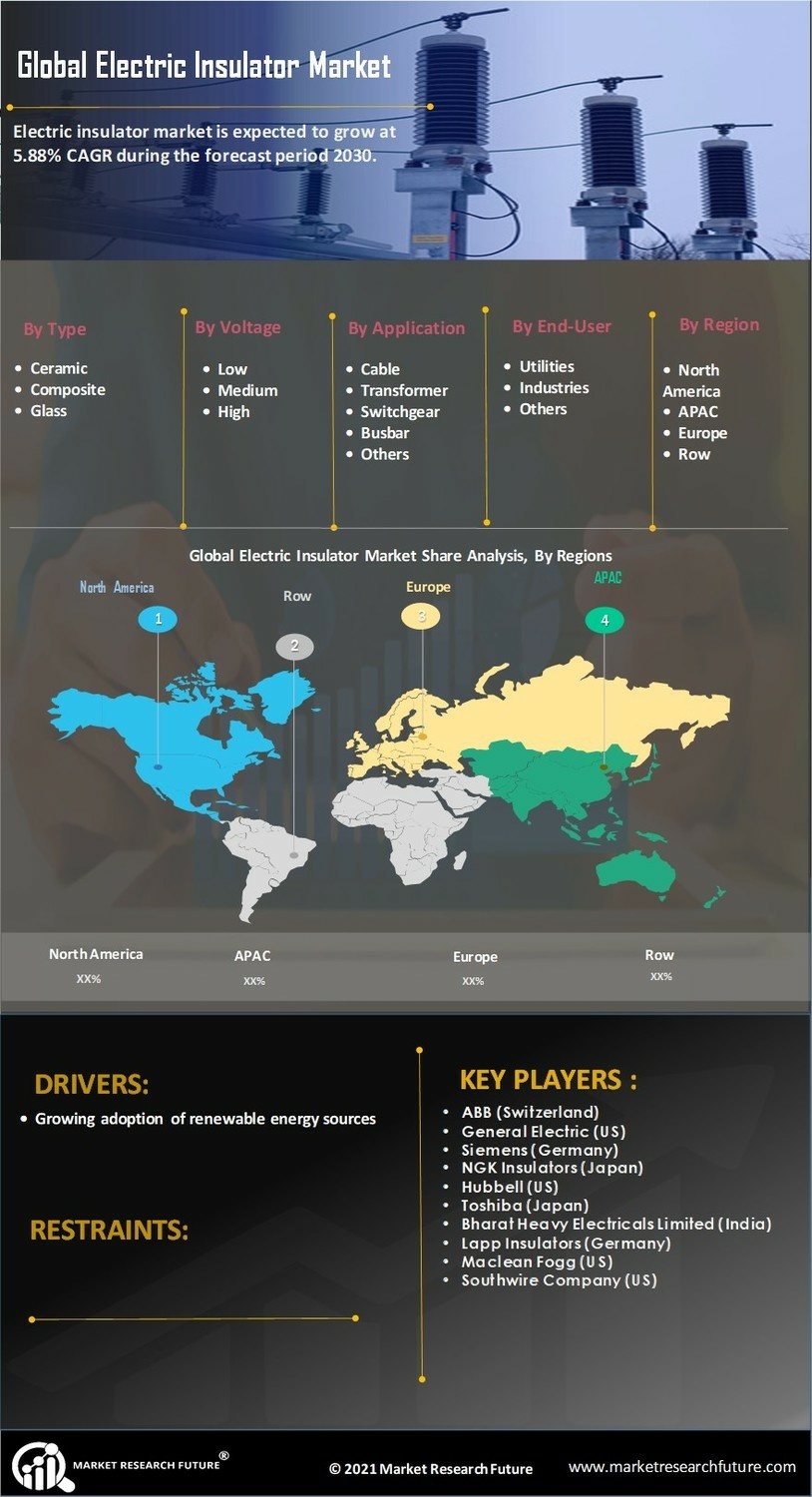

Rising Demand for Renewable Energy

The increasing emphasis on renewable energy sources, such as solar and wind, is driving the Electric Insulator Market. As countries strive to meet energy transition goals, the need for robust electrical infrastructure becomes paramount. Insulators play a critical role in ensuring the reliability and efficiency of power transmission from renewable sources. According to recent data, investments in renewable energy infrastructure are projected to reach trillions of dollars over the next decade, further propelling the demand for high-quality insulators. This trend indicates a shift towards sustainable energy solutions, which necessitates advanced insulator technologies to withstand varying environmental conditions. Consequently, the Electric Insulator Market is likely to experience substantial growth as utilities and energy companies adapt to these evolving energy landscapes.

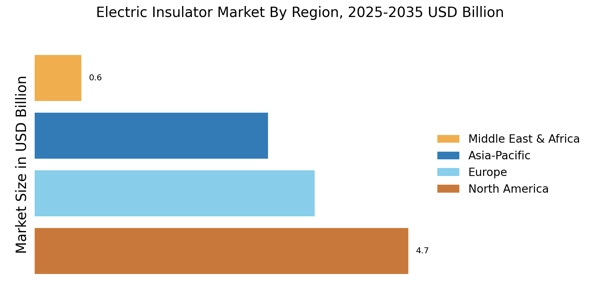

Infrastructure Development Initiatives

Infrastructure development initiatives across various regions are significantly influencing the Electric Insulator Market. Governments are increasingly investing in upgrading and expanding electrical grids to accommodate growing energy demands. For instance, the construction of new power plants and transmission lines necessitates the use of high-performance insulators to ensure safety and efficiency. Recent reports suggest that infrastructure spending is expected to increase, with billions allocated to energy projects. This surge in infrastructure development not only enhances energy distribution but also creates a favorable environment for the Electric Insulator Market to thrive. As utilities modernize their systems, the demand for innovative insulator solutions is anticipated to rise, reflecting the industry's adaptability to changing market needs.

Expansion of Electric Vehicle Infrastructure

The expansion of electric vehicle (EV) infrastructure is emerging as a significant driver for the Electric Insulator Market. As the adoption of electric vehicles accelerates, the demand for charging stations and related electrical infrastructure is surging. This necessitates the use of reliable insulators to ensure safe and efficient power distribution at charging points. Recent projections suggest that the EV market will continue to grow exponentially, leading to increased investments in supporting infrastructure. Consequently, the Electric Insulator Market is likely to benefit from this trend, as manufacturers develop specialized insulators tailored for EV applications. This expansion not only supports the transition to cleaner transportation but also presents new opportunities for innovation within the insulator sector.

Technological Innovations in Insulator Design

Technological innovations in insulator design are reshaping the Electric Insulator Market. Advances in materials science and engineering have led to the development of insulators that offer improved performance, durability, and resistance to environmental factors. For example, composite insulators are gaining traction due to their lightweight properties and superior electrical performance. The market for these advanced insulators is projected to grow as utilities seek to enhance grid reliability and reduce maintenance costs. Furthermore, the integration of smart technologies into insulator systems is expected to provide real-time monitoring capabilities, thereby increasing operational efficiency. This trend indicates a shift towards more sophisticated insulator solutions, positioning the Electric Insulator Market for sustained growth in the coming years.

Increased Focus on Electrical Safety Standards

The heightened focus on electrical safety standards is a crucial driver for the Electric Insulator Market. Regulatory bodies are implementing stricter guidelines to ensure the safety and reliability of electrical systems. This regulatory environment compels manufacturers to produce insulators that meet or exceed these safety standards. As a result, there is a growing demand for high-quality insulators that can withstand extreme conditions and prevent electrical failures. Recent data indicates that compliance with safety regulations is becoming a priority for utilities, leading to increased investments in advanced insulator technologies. This trend not only enhances public safety but also fosters innovation within the Electric Insulator Market, as companies strive to develop products that align with evolving safety requirements.