Rising Demand for Electric Vehicles

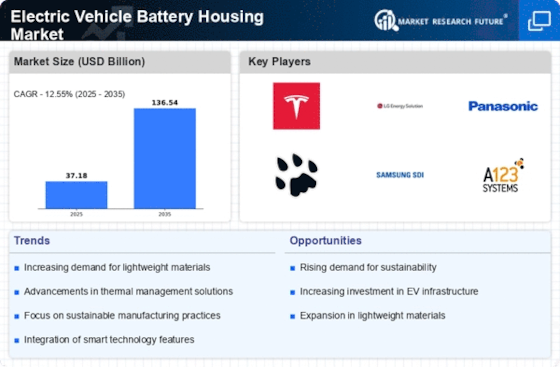

The increasing consumer preference for electric vehicles (EVs) is a primary driver for the Electric Vehicle Battery Housing Market. As more individuals and businesses transition to EVs, the demand for efficient and durable battery housings rises. According to recent data, the EV market is projected to grow at a compound annual growth rate (CAGR) of over 20% through the next decade. This surge in demand necessitates advanced battery housing solutions that can accommodate larger battery packs while ensuring safety and performance. Consequently, manufacturers are focusing on developing innovative battery housing designs that enhance thermal management and structural integrity, thereby propelling the Electric Vehicle Battery Housing Market forward.

Expansion of Charging Infrastructure

The expansion of charging infrastructure is a significant factor influencing the Electric Vehicle Battery Housing Market. As more charging stations are established, the convenience of owning an electric vehicle increases, thereby driving demand for EVs and their components, including battery housings. Recent reports indicate that the number of public charging stations is expected to double in the next five years, which will likely lead to a corresponding increase in battery housing requirements. This infrastructure development not only supports the growth of the electric vehicle market but also necessitates advancements in battery housing technology to ensure compatibility and efficiency, further propelling the Electric Vehicle Battery Housing Market.

Focus on Sustainability and Recycling

The growing emphasis on sustainability and recycling within the automotive sector is a crucial driver for the Electric Vehicle Battery Housing Market. As environmental concerns escalate, manufacturers are increasingly adopting eco-friendly materials and practices in battery housing production. The push for circular economy principles encourages the development of battery housings that can be easily recycled or repurposed at the end of their lifecycle. This trend not only aligns with consumer preferences for sustainable products but also complies with emerging regulations on waste management. Consequently, the Electric Vehicle Battery Housing Market is likely to witness a shift towards more sustainable practices, enhancing its appeal to environmentally conscious consumers.

Government Regulations and Incentives

Government regulations aimed at reducing carbon emissions and promoting electric mobility are pivotal in shaping the Electric Vehicle Battery Housing Market. Many countries have implemented stringent emission standards and are offering incentives for EV adoption, which in turn boosts the demand for electric vehicles and their components, including battery housings. For example, tax credits and rebates for EV purchases have been shown to increase sales significantly. As regulatory frameworks evolve, manufacturers are compelled to innovate and produce battery housings that meet these new standards, thus fostering growth in the Electric Vehicle Battery Housing Market.

Technological Advancements in Battery Design

Technological innovations in battery design significantly influence the Electric Vehicle Battery Housing Market. The advent of solid-state batteries and improvements in lithium-ion technology are reshaping the landscape. These advancements not only enhance energy density but also require specialized housing solutions to optimize performance and safety. For instance, solid-state batteries, which are anticipated to dominate the market by 2030, necessitate robust and lightweight housings to support their unique characteristics. As manufacturers invest in research and development, the demand for sophisticated battery housings that can accommodate these new technologies is expected to rise, thereby driving growth in the Electric Vehicle Battery Housing Market.