Aging Population

The aging population is a significant demographic factor influencing the Erectile Dysfunction Devices Market. As life expectancy increases, a larger segment of the population is entering age brackets where erectile dysfunction becomes more prevalent. Research suggests that the incidence of ED increases with age, with a notable rise in men over 50. This demographic shift is expected to create a sustained demand for erectile dysfunction devices, as older men seek solutions to maintain their sexual health and quality of life. Additionally, the growing emphasis on healthy aging and sexual wellness among older adults is likely to further stimulate interest in the Erectile Dysfunction Devices Market. Manufacturers are thus encouraged to tailor their products to meet the specific needs of this demographic.

Increased Awareness and Education

Increased awareness and education regarding erectile dysfunction are pivotal in shaping the Erectile Dysfunction Devices Market. Public health campaigns and educational initiatives have played a crucial role in destigmatizing ED, encouraging men to seek help. As awareness grows, more individuals are likely to consult healthcare professionals about their symptoms, leading to higher diagnosis rates. This trend is supported by data indicating that men who are informed about treatment options are more inclined to pursue them. Consequently, the Erectile Dysfunction Devices Market is expected to benefit from this heightened awareness, as more patients seek out devices and therapies to manage their condition effectively. The ongoing efforts to educate the public about ED will likely continue to drive market growth.

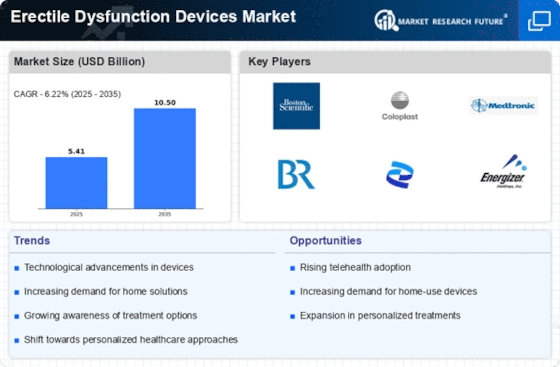

Innovations in Medical Technology

Innovations in medical technology are transforming the Erectile Dysfunction Devices Market. The advent of advanced devices, such as vacuum erection devices, penile implants, and emerging therapies, has enhanced treatment efficacy and patient satisfaction. For instance, the development of minimally invasive surgical techniques and biocompatible materials has improved the safety and effectiveness of penile implants. Furthermore, the integration of smart technology into ED devices, such as Bluetooth-enabled pumps, allows for better user experience and monitoring. As these innovations continue to evolve, they are expected to attract a broader consumer base, thereby driving growth in the Erectile Dysfunction Devices Market. The market is projected to expand as manufacturers invest in research and development to create more effective and user-friendly solutions.

Rising Prevalence of Erectile Dysfunction

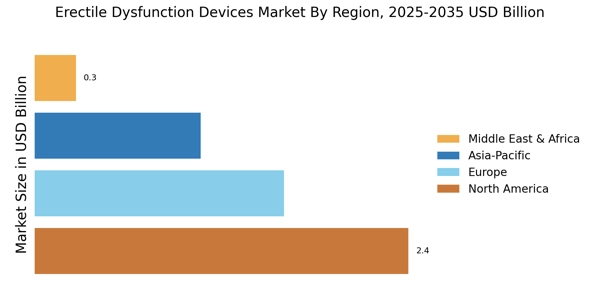

The increasing prevalence of erectile dysfunction (ED) is a primary driver for the Erectile Dysfunction Devices Market. Studies indicate that approximately 30 million men in the United States experience ED, with prevalence rates rising due to factors such as aging populations and lifestyle choices. As the population ages, the incidence of ED is expected to grow, leading to a heightened demand for effective treatment options. This trend is further exacerbated by the growing awareness of ED as a common health issue, prompting more individuals to seek medical advice and treatment. Consequently, the Erectile Dysfunction Devices Market is likely to witness significant growth as healthcare providers expand their offerings to include a variety of devices designed to address this condition.

Expansion of E-commerce and Online Sales Channels

The expansion of e-commerce and online sales channels is reshaping the Erectile Dysfunction Devices Market. The convenience of purchasing medical devices online has made it easier for consumers to access a variety of ED treatment options discreetly. This trend is particularly appealing to men who may feel embarrassed about seeking treatment in person. Data indicates that online sales of medical devices have surged, with many consumers preferring the privacy and ease of online shopping. As e-commerce platforms continue to grow, they are likely to play a crucial role in the distribution of erectile dysfunction devices. This shift not only broadens market reach but also enhances competition among manufacturers, potentially leading to better pricing and product offerings in the Erectile Dysfunction Devices Market.