Aging Population

The aging population is a critical driver of the Erectile Dysfunction Drugs Market. As individuals age, the prevalence of erectile dysfunction tends to increase, with studies indicating that approximately 50% of men aged 40 to 70 experience some degree of erectile dysfunction.

This demographic shift suggests a growing market for erectile dysfunction drugs, as older men are more likely to seek treatment. Furthermore, the increasing life expectancy in many regions contributes to a larger segment of the population that may require these medications.

The Erectile Dysfunction Drugs Market is thus poised to expand, driven by the need to address the sexual health concerns of an aging male population.

Advancements in Drug Development

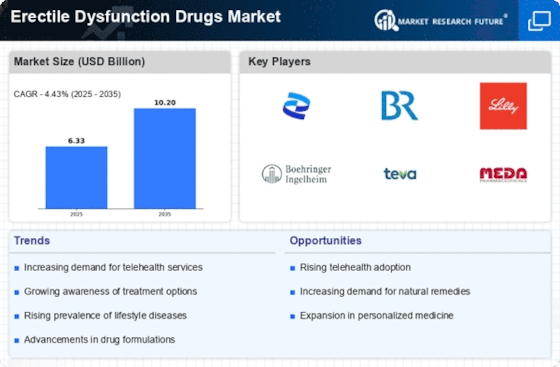

Advancements in drug development and formulation are propelling the Erectile Dysfunction Drugs Market forward. The introduction of new medications with improved efficacy and fewer side effects enhances treatment options for patients.

For instance, the development of PDE5 inhibitors has revolutionized the management of erectile dysfunction, providing effective solutions for many men. Additionally, ongoing research into alternative therapies and combination treatments may further expand the market.

As pharmaceutical companies invest in innovative solutions, the Erectile Dysfunction Drugs Market is expected to experience growth driven by these advancements in drug development.

Increased Focus on Sexual Health

There is an increasing focus on sexual health and wellness, which serves as a vital driver for the Erectile Dysfunction Drugs Market.

As societal norms evolve, more men are becoming open to discussing sexual health issues, leading to greater awareness and acceptance of erectile dysfunction treatments.

This shift is reflected in the growing number of advertisements and educational campaigns aimed at destigmatizing erectile dysfunction.

Consequently, the Erectile Dysfunction Drugs Market is likely to benefit from heightened consumer interest and willingness to seek treatment, resulting in increased sales and market penetration for erectile dysfunction drugs.

Telemedicine and Online Pharmacies

The rise of telemedicine and online pharmacies is transforming the Erectile Dysfunction Drugs Market. With the increasing acceptance of remote healthcare services, patients can now consult healthcare professionals and obtain prescriptions for erectile dysfunction medications from the comfort of their homes.

This convenience is particularly appealing to men who may feel embarrassed about discussing their condition in person. The accessibility of online pharmacies also facilitates the purchase of these medications, potentially increasing market reach.

As telemedicine continues to gain traction, the Erectile Dysfunction Drugs Market is likely to see a surge in demand, driven by the ease of access to treatment options.

Rising Incidence of Chronic Diseases

The rising incidence of chronic diseases such as diabetes, hypertension, and cardiovascular conditions significantly impacts the Erectile Dysfunction Drugs Market.

These health issues are known to contribute to erectile dysfunction, with studies indicating that men with diabetes are three times more likely to experience erectile dysfunction than those without.

As the prevalence of these chronic conditions continues to rise, the demand for effective erectile dysfunction treatments is likely to increase.

This trend suggests that the Erectile Dysfunction Drugs Market will see sustained growth, as healthcare providers seek to address the sexual health needs of patients suffering from these chronic ailments.