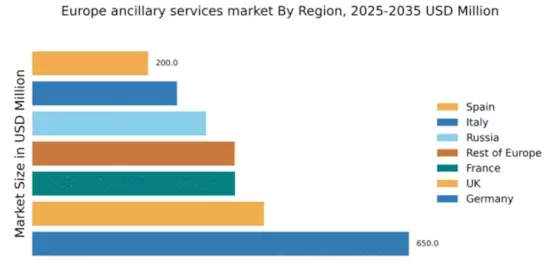

Germany : Strong Infrastructure and Innovation Drive Growth

Key markets include major cities like Berlin, Munich, and Hamburg, where demand for ancillary services is surging. The competitive landscape features prominent players such as RWE and E.ON, which dominate the market with innovative solutions. Local dynamics are characterized by a strong push for sustainability, with businesses increasingly adopting green technologies. The industrial sector, particularly automotive and manufacturing, is a significant consumer of ancillary services, driving further market expansion.

UK : Transitioning to a Low-Carbon Economy

Key markets include London, Manchester, and Birmingham, where energy consumption is high. The competitive landscape features major players like E.ON and Orsted, which are actively expanding their service offerings. Local market dynamics are influenced by a strong emphasis on sustainability and innovation, with businesses increasingly seeking energy efficiency solutions. The commercial sector, particularly in technology and finance, is a significant driver of ancillary service demand.

France : Innovative Policies Fuel Market Growth

Key markets include Paris, Lyon, and Marseille, where energy consumption is significant. The competitive landscape features major players like Engie and EDF, which are well-positioned to capitalize on the energy transition. Local dynamics are characterized by a strong regulatory environment that encourages innovation and investment in clean technologies. The residential sector is increasingly adopting smart energy solutions, driving demand for ancillary services.

Russia : Diverse Energy Landscape and Demand

Key markets include Moscow, St. Petersburg, and the Ural region, where industrial activity is concentrated. The competitive landscape features local players like Inter RAO and RusHydro, which dominate the market. Local dynamics are influenced by a complex regulatory environment and varying regional policies. The industrial sector, particularly heavy manufacturing, is a significant consumer of ancillary services, driving market stability.

Italy : Renewable Energy Adoption Accelerates Growth

Key markets include Rome, Milan, and Naples, where energy consumption is high. The competitive landscape features players like Enel and E.ON, which are expanding their service offerings. Local dynamics are characterized by a strong push for sustainability, with businesses increasingly adopting green technologies. The residential sector is a significant driver of ancillary service demand, particularly in energy management solutions.

Spain : Innovative Solutions Drive Market Growth

Key markets include Madrid, Barcelona, and Valencia, where energy consumption is significant. The competitive landscape features major players like Iberdrola and Siemens Gamesa, which are leading the charge in renewable energy solutions. Local dynamics are influenced by a favorable regulatory environment that encourages innovation and investment. The commercial sector, particularly in tourism and services, is a significant driver of ancillary service demand.

Rest of Europe : Varied Regulatory Environments Shape Growth

Key markets include cities across Scandinavia, Eastern Europe, and the Balkans, where energy consumption varies widely. The competitive landscape features a mix of local and international players, each adapting to unique market conditions. Local dynamics are shaped by differing regulatory frameworks and energy policies, impacting the business environment. The industrial sector, particularly in manufacturing and services, plays a crucial role in driving demand for ancillary services.