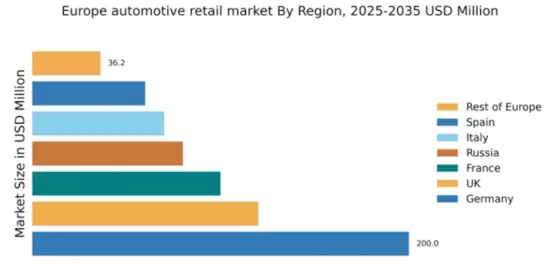

Germany : Strong Growth and Innovation Hub

Germany holds a commanding market share of 200.0, representing a significant portion of Europe's automotive retail landscape. Key growth drivers include a robust manufacturing base, increasing consumer demand for electric vehicles (EVs), and government incentives promoting sustainable transport. Regulatory policies favoring emissions reductions and investments in infrastructure, such as charging stations, further bolster market expansion. The industrial development in regions like Bavaria and Baden-Württemberg enhances production capabilities and innovation.

UK : Evolving Consumer Preferences Drive Change

The UK automotive retail market, valued at 120.0, is adapting to shifting consumer preferences, particularly towards EVs and hybrid vehicles. Growth is driven by government initiatives aimed at reducing carbon emissions and enhancing public transport infrastructure. Demand trends indicate a rise in online vehicle sales and subscription models, reflecting changing consumer behavior. The competitive landscape is characterized by both established players and new entrants focusing on digital retailing.

France : Innovation and Sustainability at Forefront

France's automotive retail market, valued at 100.0, is witnessing growth fueled by a strong demand for eco-friendly vehicles and government support for green technologies. Key growth drivers include incentives for EV purchases and investments in charging infrastructure. The market is characterized by a mix of traditional dealerships and innovative online platforms. Cities like Paris and Lyon are pivotal markets, showcasing a blend of luxury and mass-market vehicles.

Russia : Growth Potential in Automotive Sector

Russia's automotive retail market, valued at 80.0, is characterized by a growing middle class and increasing vehicle ownership rates. Key growth drivers include government support for local manufacturing and a shift towards more affordable vehicle options. Demand trends show a preference for SUVs and crossovers, particularly in urban areas like Moscow and St. Petersburg. The competitive landscape includes both domestic and international players, adapting to local consumer preferences.

Italy : Strong Presence of Local Brands

Italy's automotive retail market, valued at 70.0, is distinguished by a rich automotive heritage and a strong presence of local brands like Fiat and Ferrari. Growth is driven by a resurgence in consumer interest in classic and luxury vehicles, alongside a push for EV adoption. Key markets include Milan and Turin, where automotive culture thrives. The competitive landscape features a mix of traditional dealerships and innovative online sales platforms.

Spain : Focus on Sustainability and Technology

Spain's automotive retail market, valued at 60.0, is experiencing growth driven by increasing demand for sustainable vehicles and technological advancements. Government initiatives promoting EV adoption and infrastructure development are key growth factors. Major cities like Madrid and Barcelona are central to market dynamics, showcasing a blend of traditional and modern retail approaches. The competitive landscape includes both local and international players, adapting to evolving consumer needs.

Rest of Europe : Diverse Opportunities Across Regions

The Rest of Europe automotive retail market, valued at 36.19, presents a fragmented landscape with diverse trends across different countries. Growth drivers include varying consumer preferences, regulatory environments, and economic conditions. Demand for both traditional and electric vehicles is evident, with local players adapting to specific market needs. The competitive landscape is characterized by a mix of established brands and emerging players, each catering to unique regional demands.