Rise of Omnichannel Retailing

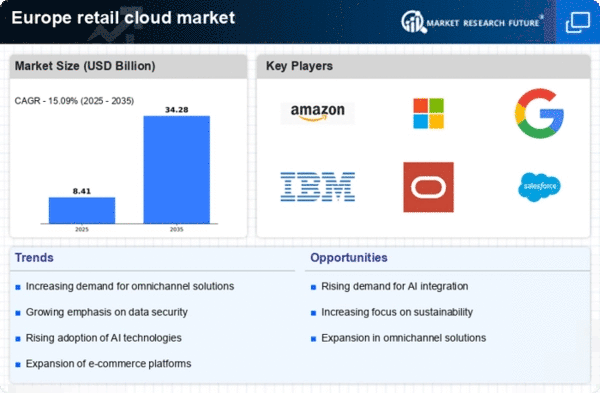

The retail cloud market in Europe is significantly influenced by the rise of omnichannel retailing strategies. Retailers are increasingly adopting a unified approach to customer engagement across various channels, including online, mobile, and physical stores. This trend necessitates the implementation of cloud-based solutions that provide a cohesive view of customer interactions and inventory management. In 2025, it is anticipated that omnichannel sales will account for over 60% of total retail sales in Europe. The retail cloud market is thus positioned to benefit from this shift, as businesses seek to enhance customer experiences and streamline operations through integrated cloud platforms. The ability to provide a seamless shopping experience is becoming a critical differentiator in the competitive retail landscape.

Growing Demand for Scalability

The retail cloud market in Europe is witnessing a growing demand for scalability among retailers. As businesses expand and adapt to changing market conditions, the need for flexible cloud solutions becomes paramount. Retailers are increasingly seeking cloud services that can scale according to their operational requirements, allowing them to manage fluctuating customer demands effectively. By 2025, it is expected that the cloud services market in retail will grow by approximately 25%, driven by the need for scalable solutions. This trend is particularly relevant for small and medium-sized enterprises (SMEs) that require cost-effective cloud options to compete with larger players. The retail cloud market is thus likely to thrive as scalability becomes a key consideration for retailers.

Expansion of E-commerce Platforms

The retail cloud market in Europe is experiencing a notable surge due to the rapid expansion of e-commerce platforms. As consumers increasingly prefer online shopping, retailers are compelled to adopt cloud solutions that facilitate seamless transactions and inventory management. In 2025, it is estimated that e-commerce sales in Europe will reach approximately €500 billion, indicating a robust growth trajectory. This shift necessitates the integration of cloud technologies to enhance operational efficiency and customer engagement. Retailers are leveraging cloud-based tools to optimize supply chains, manage customer data, and provide real-time analytics. Consequently, the retail cloud market is poised for significant growth as businesses seek to capitalize on the burgeoning e-commerce landscape.

Integration of Advanced Analytics

The retail cloud market in Europe is being driven by the integration of advanced analytics into retail operations. Retailers are increasingly recognizing the value of data-driven decision-making, which is facilitated by cloud-based analytics solutions. By 2025, it is projected that the demand for analytics tools in retail will grow by over 30%. These tools enable retailers to gain insights into consumer behavior, optimize pricing strategies, and enhance inventory management. The ability to analyze vast amounts of data in real-time allows retailers to respond swiftly to market trends and consumer preferences. As a result, the retail cloud market is likely to witness substantial growth as businesses invest in analytics capabilities to remain competitive.

Emphasis on Sustainability Initiatives

The retail cloud market in Europe is increasingly shaped by an emphasis on sustainability initiatives among retailers. As consumers become more environmentally conscious, businesses are adopting cloud solutions that support sustainable practices. This includes optimizing supply chains to reduce carbon footprints and utilizing cloud-based tools for efficient resource management. In 2025, it is projected that over 40% of retailers in Europe will prioritize sustainability in their operations. The retail cloud market is expected to benefit from this trend, as cloud technologies enable retailers to track and report on their sustainability efforts effectively. By aligning with consumer values, retailers can enhance brand loyalty and drive growth in the retail cloud market.