Expansion of E-commerce Platforms

The retail cloud market is experiencing a notable surge due to the rapid expansion of e-commerce. As consumers increasingly prefer online shopping, retailers are compelled to adopt cloud solutions that facilitate seamless transactions and inventory management. In 2025, e-commerce sales in the US are projected to reach approximately $1 trillion, indicating a robust growth trajectory. This shift necessitates the integration of cloud technologies to enhance operational efficiency and customer experience. Retailers leveraging cloud solutions can optimize their supply chains, effectively manage customer data, and provide personalized shopping experiences. Consequently, the retail cloud market is likely to witness significant investments as businesses seek to capitalize on the growing demand for online retail services.

Integration of Advanced Analytics

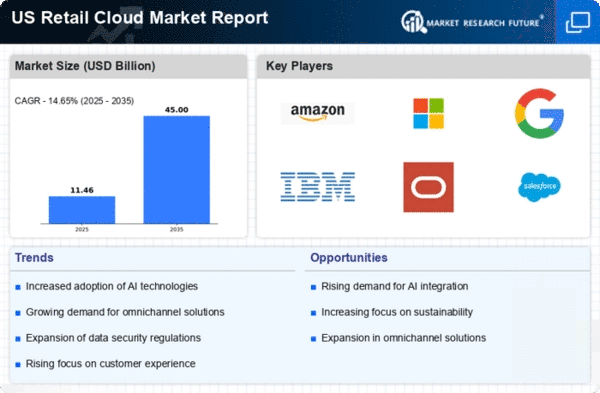

The retail cloud market is significantly influenced by the integration of advanced analytics into retail operations. Retailers are increasingly utilizing cloud-based analytics tools to gain insights into consumer behavior, sales trends, and inventory management. This trend is expected to drive the market as businesses aim to make data-driven decisions. In 2025, the market for retail analytics is anticipated to reach $10 billion in the US, highlighting the importance of analytics in enhancing operational efficiency. By leveraging cloud solutions, retailers can analyze vast amounts of data in real-time, enabling them to respond swiftly to market changes and consumer preferences. This capability not only improves customer satisfaction but also enhances profitability, thereby propelling the growth of the retail cloud market.

Rise of Subscription-Based Models

The retail cloud market is witnessing a rise in subscription-based models, which are reshaping traditional retail paradigms. Retailers are increasingly adopting cloud solutions that support subscription services, allowing them to create recurring revenue streams. This model is particularly appealing in sectors such as fashion and consumer goods, where customers appreciate the convenience of regular deliveries. In 2025, it is estimated that subscription-based retail will account for 20% of total retail sales in the US. This shift necessitates robust cloud infrastructure to manage subscriptions, customer data, and inventory efficiently. As more retailers embrace this model, the retail cloud market is likely to experience substantial growth, driven by the demand for innovative and flexible retail solutions.

Enhancement of Customer Experience

The retail cloud market is increasingly driven by enhancing customer experience through innovative cloud-based solutions. Retailers are adopting cloud technologies to provide personalized shopping experiences, streamline customer interactions, and improve service delivery. In 2025, it is projected that 60% of retailers will implement cloud solutions aimed at enhancing customer engagement. This focus on customer experience is crucial as it directly impacts customer loyalty and retention. By utilizing cloud platforms, retailers can gather and analyze customer data to tailor their offerings, thereby fostering a more engaging shopping environment. This trend not only boosts sales but also strengthens brand loyalty, contributing to the growth of the retail cloud market.

Demand for Scalability and Flexibility

The retail cloud market is being propelled by the increasing demand for scalability and flexibility. As businesses grow and evolve, they require cloud solutions that can easily scale to accommodate fluctuating demands. This need is particularly pronounced during peak shopping seasons, where retailers must quickly adjust their operations. The ability to scale resources up or down without significant capital investment is a key advantage of cloud technologies. In 2025, it is estimated that 70% of retailers in the US will prioritize cloud solutions that offer scalability. This trend indicates a shift towards more agile retail operations, allowing businesses to respond effectively to market dynamics. Consequently, the retail cloud market is likely to expand as more retailers recognize the benefits of flexible cloud solutions.