Growth of the Automotive Sector

The automotive wiring-harness market in Europe is benefiting from the overall growth of the automotive sector. As vehicle production increases, so does the demand for wiring harnesses, which are essential components in modern vehicles. In 2025, the European automotive industry is projected to produce over 15 million vehicles, leading to a corresponding rise in the need for wiring solutions. This growth is particularly pronounced in the electric vehicle segment, where wiring harnesses play a critical role in connecting various electronic systems. The automotive wiring-harness market is thus positioned to capitalize on this upward trend, with manufacturers likely to expand their production capacities to meet the increasing demand. Additionally, the trend towards vehicle customization is further driving the need for diverse wiring solutions.

Regulatory Compliance and Safety Standards

The automotive wiring-harness market in Europe is significantly influenced by stringent regulatory compliance and safety standards. The European Union has implemented various regulations aimed at enhancing vehicle safety and environmental performance. Compliance with these regulations often requires the use of advanced wiring solutions that meet specific safety criteria. For example, the introduction of the Euro 6 emissions standard has led to increased demand for wiring harnesses that support advanced engine management systems. As a result, manufacturers are compelled to innovate and adapt their products to meet these evolving standards, which is likely to drive growth in the automotive wiring-harness market. The financial implications of non-compliance can be substantial, further incentivizing manufacturers to invest in high-quality wiring solutions.

Technological Advancements in Automotive Wiring

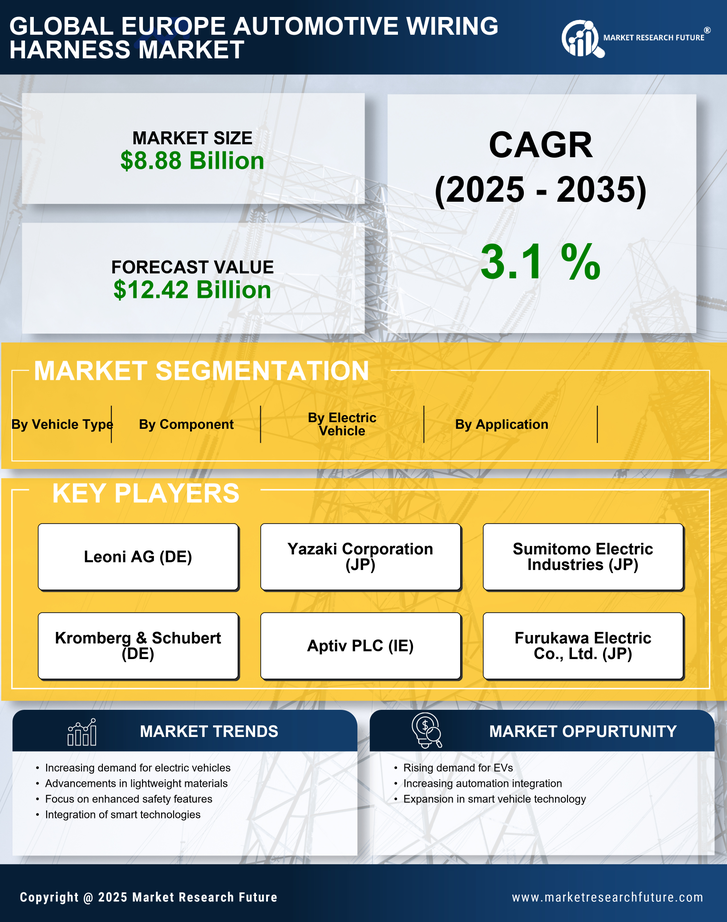

The automotive wiring-harness market in Europe is experiencing a surge due to rapid technological advancements. Innovations in materials and manufacturing processes are enhancing the efficiency and reliability of wiring harnesses. For instance, the integration of advanced insulation materials and connectors is improving performance in electric and hybrid vehicles. As of 2025, the market is projected to grow at a CAGR of approximately 6.5%, driven by the increasing complexity of automotive electronics. This complexity necessitates more sophisticated wiring solutions, thereby propelling demand within the automotive wiring-harness market. Furthermore, the adoption of automation in production processes is expected to reduce costs and improve quality, making European manufacturers more competitive on a global scale.

Rising Consumer Demand for Connectivity Features

The automotive wiring-harness market in Europe is increasingly shaped by rising consumer demand for connectivity features in vehicles. Modern consumers expect their vehicles to be equipped with advanced infotainment systems, navigation, and driver-assistance technologies. These features require sophisticated wiring harnesses that can support high data transmission rates and integrate various electronic components. As of 2025, it is estimated that over 70% of new vehicles will include some form of connected technology, thereby driving demand for specialized wiring solutions. The automotive wiring-harness market must adapt to these changing consumer preferences, which may involve investing in research and development to create innovative wiring designs that enhance connectivity and user experience.

Focus on Cost Efficiency and Supply Chain Optimization

The automotive wiring-harness market in Europe is also influenced by a growing focus on cost efficiency and supply chain optimization. Manufacturers are increasingly seeking ways to reduce production costs while maintaining high-quality standards. This trend is prompting companies to explore alternative sourcing strategies and materials that can lower expenses. For instance, the use of recycled materials in wiring harness production is gaining traction, as it not only reduces costs but also aligns with sustainability goals. In 2025, it is anticipated that companies prioritizing cost efficiency will capture a larger market share within the automotive wiring-harness market. Additionally, optimizing supply chains can lead to faster production times and improved responsiveness to market demands, further enhancing competitiveness.