Rising Demand for Electric Vehicles

The automotive wiring-harness market experiences a notable surge in demand due to the increasing adoption of electric vehicles (EVs) in Thailand. As consumers become more environmentally conscious, the shift towards EVs necessitates advanced wiring solutions that can handle higher voltage and complex electrical systems. This transition is reflected in the automotive sector, where EV sales have reportedly increased by over 30% in recent years. Consequently, manufacturers are compelled to innovate and enhance their wiring-harness designs to accommodate the unique requirements of EVs, thereby driving growth in the automotive wiring-harness market. The integration of sophisticated technologies, such as battery management systems and regenerative braking, further emphasizes the need for specialized wiring solutions, indicating a robust future for the market in Thailand.

Government Initiatives and Regulations

Government policies and regulations play a pivotal role in shaping the automotive wiring-harness market in Thailand. The Thai government has implemented various initiatives aimed at promoting sustainable transportation, including incentives for EV production and stricter emissions standards. These regulations encourage automotive manufacturers to invest in advanced wiring technologies that comply with new standards. For instance, the introduction of tax benefits for EV manufacturers has led to a projected growth of 25% in the EV segment, subsequently increasing the demand for specialized wiring-harness solutions. As manufacturers adapt to these regulatory changes, the automotive wiring-harness market is likely to expand, driven by the need for compliance and innovation in wiring systems.

Consumer Preferences for Advanced Features

Consumer preferences in Thailand are shifting towards vehicles equipped with advanced features, which is influencing the automotive wiring-harness market. As buyers increasingly seek vehicles with enhanced safety, connectivity, and entertainment options, manufacturers are compelled to integrate more sophisticated wiring systems. The demand for features such as lane-keeping assist, adaptive cruise control, and integrated infotainment systems is on the rise, leading to a projected increase of 20% in the market for high-tech vehicles. This trend necessitates the development of specialized wiring harnesses that can support these advanced functionalities, thereby driving innovation and growth within the automotive wiring-harness market. As consumer expectations evolve, manufacturers must adapt their wiring solutions to meet these new demands.

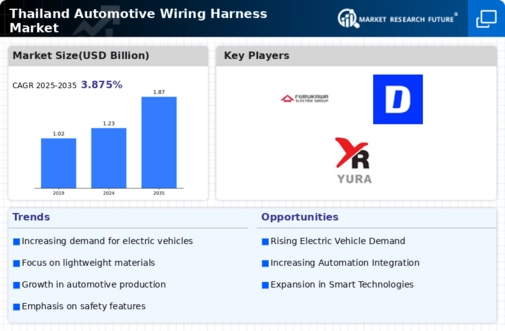

Growth of the Automotive Manufacturing Sector

The automotive manufacturing sector in Thailand is witnessing robust growth, which directly impacts the automotive wiring-harness market. With Thailand being a prominent hub for automotive production in Southeast Asia, the influx of both domestic and international manufacturers has led to increased demand for wiring harnesses. Recent data indicates that automotive production in Thailand has reached approximately 2 million units annually, with a significant portion requiring advanced wiring solutions. This growth is further fueled by the expansion of local suppliers and the establishment of new manufacturing plants, which enhances the supply chain for wiring harnesses. As the automotive sector continues to thrive, the automotive wiring-harness market is poised for substantial growth, driven by the rising production volumes.

Technological Innovations in Automotive Design

Technological advancements in automotive design significantly influence the automotive wiring-harness market in Thailand. The integration of smart technologies, such as advanced driver-assistance systems (ADAS) and infotainment systems, necessitates more complex wiring solutions. As vehicles become increasingly connected, the demand for high-quality wiring harnesses that can support data transmission and power distribution grows. Reports indicate that the market for connected vehicles is expected to grow by 40% in the coming years, which will likely drive the automotive wiring-harness market as manufacturers seek to enhance vehicle functionality. This trend suggests that continuous innovation in wiring technology is essential to meet the evolving demands of modern automotive design.