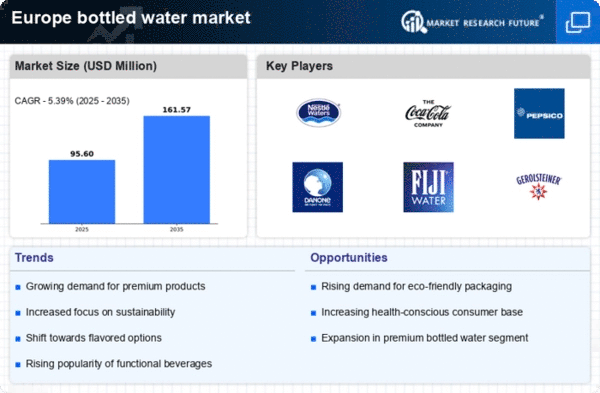

Rising Health Consciousness

The bottled water market in Europe is experiencing a notable surge in demand driven by an increasing awareness of health and wellness among consumers. As individuals become more health-conscious, they are opting for bottled water as a healthier alternative to sugary beverages. This shift is reflected in market data, indicating that bottled water consumption has risen by approximately 10% annually over the past few years. Furthermore, the trend towards hydration is supported by various health campaigns promoting the benefits of adequate water intake. As a result, the bottled water market is likely to continue expanding, with consumers prioritizing products that align with their health goals.

Convenience and On-the-Go Consumption

The bottled water market in Europe is significantly influenced by the growing demand for convenience and on-the-go consumption. Busy lifestyles have led consumers to seek easily accessible hydration options, making bottled water a preferred choice. Recent statistics reveal that nearly 60% of bottled water sales occur through convenience stores and vending machines, highlighting the importance of availability. This trend is further supported by the rise of outdoor activities and travel, where portable hydration solutions are essential. Consequently, the bottled water market is poised for growth as manufacturers adapt their distribution strategies to meet the needs of a fast-paced consumer base.

Regulatory Support and Quality Standards

The bottled water market in Europe is positively impacted by stringent regulatory support and quality standards. European regulations ensure that bottled water products meet high safety and quality benchmarks, fostering consumer trust. This regulatory framework not only protects public health but also enhances the reputation of the bottled water market. Recent data shows that compliance with these standards has led to a 5% increase in consumer confidence in bottled water products. As regulations continue to evolve, the industry is likely to benefit from increased market stability and consumer assurance, further driving growth.

Diverse Product Offerings and Customization

The bottled water market in Europe is witnessing a diversification of product offerings, catering to a wide range of consumer preferences. This includes flavored waters, mineral-infused options, and functional beverages that provide added health benefits. Market analysis suggests that flavored bottled water has seen a growth rate of approximately 15% in recent years, appealing to younger demographics seeking variety. Additionally, customization options, such as personalized labels and unique bottle designs, are becoming increasingly popular. This trend indicates that the bottled water market is evolving to meet the demands of a more discerning consumer base, potentially leading to increased sales and brand loyalty.

Environmental Awareness and Eco-Friendly Packaging

The bottled water market in Europe is increasingly shaped by heightened environmental awareness among consumers. As sustainability becomes a priority, there is a growing demand for eco-friendly packaging solutions. Recent surveys indicate that over 70% of consumers are willing to pay a premium for bottled water products that utilize recyclable or biodegradable materials. This shift is prompting manufacturers to innovate in packaging design, aiming to reduce plastic waste and enhance sustainability. The bottled water market is likely to benefit from this trend, as brands that prioritize environmental responsibility may capture a larger share of the market.