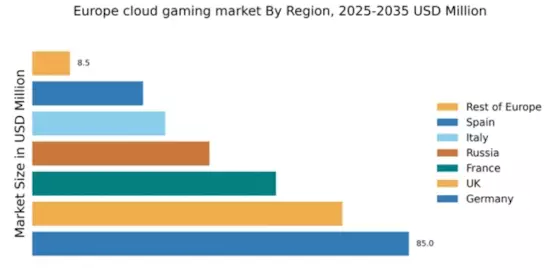

Germany : Strong Infrastructure and Consumer Demand

Key cities like Berlin, Munich, and Frankfurt are pivotal in the cloud gaming landscape, hosting major gaming events and tech hubs. The competitive landscape features significant players such as NVIDIA, Microsoft, and Ubisoft, all vying for market share. Local dynamics are characterized by a strong gaming culture and a growing interest in esports, which is driving demand for cloud gaming services. The presence of major tech firms and startups fosters innovation, making Germany a vibrant market for cloud gaming applications.

UK : Diverse Market with Strong Players

London, Manchester, and Edinburgh are key markets, with London being a hub for gaming startups and established companies. The competitive landscape includes major players like Sony and Microsoft, alongside emerging local developers. The UK market is characterized by a diverse range of gaming genres, appealing to various consumer segments. The presence of gaming conventions and events fosters community engagement and drives interest in cloud gaming solutions.

France : Cultural Affinity for Gaming

Cities like Paris, Lyon, and Marseille are central to the cloud gaming market, with Paris being a hotspot for gaming events and tech innovation. The competitive landscape features major players such as Ubisoft and Google, alongside a vibrant indie game development scene. Local dynamics are influenced by a strong gaming culture, with a focus on narrative-driven games and immersive experiences. The French market is also seeing increased investment in esports, further driving cloud gaming adoption.

Russia : Expanding Market with Unique Challenges

Moscow and St. Petersburg are key markets, with a burgeoning gaming community and tech startups. The competitive landscape includes both international players like Tencent and local developers. The market is characterized by a mix of traditional gaming and emerging cloud solutions, with a focus on mobile gaming. Local dynamics are influenced by cultural preferences for specific game genres, and the growing interest in esports is also contributing to the cloud gaming trend.

Italy : Cultural Shift Towards Digital Gaming

Cities like Milan, Rome, and Turin are central to the cloud gaming market, with Milan being a hub for tech startups and gaming events. The competitive landscape features major players such as Sony and local developers. The market is characterized by a diverse gaming culture, with a strong interest in mobile and casual gaming. Local dynamics are influenced by community-driven gaming events and a growing interest in esports, which is driving cloud gaming adoption.

Spain : Youthful Demographics Driving Growth

Key cities like Madrid, Barcelona, and Valencia are pivotal in the cloud gaming landscape, with Madrid being a hub for gaming events and tech innovation. The competitive landscape includes major players like Microsoft and local developers. The market is characterized by a vibrant gaming culture, with a focus on mobile and casual gaming. Local dynamics are influenced by community-driven gaming events and a growing interest in esports, which is driving cloud gaming adoption.

Rest of Europe : Diverse Markets with Unique Challenges

Countries like Belgium, Netherlands, and the Nordic nations are key markets, each with unique gaming cultures and preferences. The competitive landscape features a mix of local and international players, with varying degrees of market penetration. Local dynamics are influenced by cultural preferences for specific game genres and the growing interest in esports. The presence of gaming conventions and community events fosters engagement and drives interest in cloud gaming solutions.