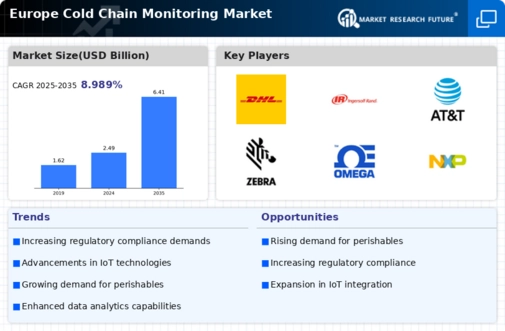

Increasing Regulatory Standards

The stringent regulatory standards imposed by European authorities regarding food safety and quality are driving the cold chain-monitoring market. Regulations such as the EU Food Safety Regulation mandate that temperature-sensitive products must be stored and transported under specific conditions. Compliance with these regulations is crucial for businesses to avoid penalties and ensure consumer safety. As a result, the cold chain-monitoring market is witnessing a surge in demand for solutions that facilitate compliance, such as automated monitoring systems and data loggers. The market is expected to expand as companies invest in technologies that help them meet these regulatory requirements effectively.

Rising Demand for Perishable Goods

The increasing consumption of perishable goods in Europe is a primary driver for the cold chain-monitoring market. As consumers become more health-conscious, the demand for fresh produce, dairy products, and meat has surged. This trend is reflected in the market data, which indicates that the perishable food segment is expected to grow at a CAGR of approximately 6.5% over the next five years. Consequently, businesses are compelled to invest in advanced cold chain-monitoring solutions to ensure product quality and safety throughout the supply chain. The cold chain-monitoring market is thus experiencing heightened activity as companies seek to maintain optimal temperature and humidity levels during transportation and storage, thereby reducing spoilage and waste.

Consumer Awareness and Demand for Quality

There is a growing consumer awareness regarding the quality and safety of food products, which is influencing the cold chain-monitoring market. Consumers are increasingly concerned about the conditions under which their food is stored and transported, leading to a demand for transparency in the supply chain. This trend is prompting retailers and manufacturers to adopt robust cold chain-monitoring solutions to assure customers of product quality. The cold chain-monitoring market is likely to benefit from this shift, as businesses strive to provide verifiable data on temperature control and product handling. This heightened focus on quality assurance is expected to drive market growth in the coming years.

Technological Integration in Supply Chains

The integration of advanced technologies such as IoT, AI, and blockchain into supply chains is significantly influencing the cold chain-monitoring market. These technologies enable real-time tracking and monitoring of temperature-sensitive products, enhancing transparency and efficiency. For instance, IoT devices can provide continuous temperature data, allowing for immediate corrective actions if deviations occur. The cold chain-monitoring market is projected to witness a growth rate of around 8% annually as businesses adopt these technologies to improve operational efficiency and reduce losses. This technological shift not only optimizes logistics but also fosters consumer trust by ensuring product integrity from farm to table.

Expansion of E-commerce and Online Grocery Services

The rapid expansion of e-commerce and online grocery services in Europe is a significant driver for the cold chain-monitoring market. As more consumers turn to online platforms for their grocery needs, the demand for efficient cold chain logistics has intensified. E-commerce companies are increasingly investing in cold chain-monitoring solutions to ensure that perishable items are delivered in optimal conditions. The cold chain-monitoring market is projected to grow as these companies seek to enhance their logistics capabilities and meet consumer expectations for fresh and safe products. This trend is likely to continue as the online grocery sector expands, further driving the need for effective cold chain solutions.